Table of Contents

The IRS Volunteer Tax Assistance Program (VITA) offers free tax preparation services to low-income individuals and families. Trained volunteers provide assistance in preparing and filing tax returns, ensuring accuracy and maximizing eligible credits and deductions. This program aims to alleviate the financial burden of tax preparation for those who cannot afford professional help, promoting financial stability and compliance with tax laws.

The IRS Volunteer Tax Assistance (VITA) Program is a remarkable initiative that offers free tax preparation services to individuals and families who earn a limited income, have disabilities, or face language barriers. This program is a beacon of hope for those who may struggle with navigating the complex world of tax filing, providing them with much-needed support and guidance. With the help of dedicated volunteers, VITA ensures that everyone can access professional tax assistance, regardless of their financial resources. By taking advantage of this program, individuals can save money on tax preparation fees and maximize their refunds, ultimately improving their financial well-being.

The IRS Volunteer Tax Assistance Program: Providing Professional Assistance to Taxpayers

The Internal Revenue Service (IRS) Volunteer Tax Assistance (VITA) program is an initiative that aims to help eligible taxpayers in preparing their tax returns. This program utilizes trained volunteers who provide free tax preparation assistance to individuals and families with low to moderate incomes, the elderly, persons with disabilities, and limited English-speaking taxpayers. The VITA program, which began in 1971, has been a great success in ensuring that every taxpayer receives the necessary support to fulfill their tax obligations accurately and efficiently.

Eligibility for the VITA Program

To qualify for assistance through the VITA program, taxpayers must generally have an income below a specific threshold. The exact income limit varies each year and is determined by the IRS. Generally, the program is designed to assist individuals and families with low to moderate incomes. Additionally, the VITA program also provides assistance to individuals with disabilities, the elderly, and limited English-speaking taxpayers who may face challenges in understanding tax laws and regulations.

Services Offered by VITA

The VITA program offers several services to taxpayers, including:

- Tax Return Preparation: Trained volunteers assist eligible individuals in preparing their federal tax returns. They ensure that all necessary forms and schedules are properly completed, helping taxpayers to accurately report their income, deductions, and credits.

- E-File Services: VITA provides electronic filing services, allowing taxpayers to submit their returns electronically. This ensures faster processing and quicker receipt of any refunds owed.

- Information on Tax Credits: Volunteers inform taxpayers about various tax credits they may be eligible for, such as the Earned Income Tax Credit (EITC) or the Child Tax Credit (CTC). They explain the eligibility criteria and help taxpayers claim these credits if applicable.

- Taxpayer Education: The VITA program also focuses on educating taxpayers about their tax obligations and rights. Volunteers provide resources and materials that help individuals become more informed about the tax system, enabling them to make better financial decisions.

How to Access VITA Services

To avail of the VITA program’s assistance, taxpayers can find their nearest VITA site by using the IRS online locator tool. This tool allows individuals to search by ZIP code and identifies nearby VITA locations, providing contact information and operating hours. Once taxpayers identify a suitable site, they can schedule an appointment or drop in during opening hours to receive the necessary assistance with their tax returns.

The Benefits of the VITA Program

The VITA program offers numerous benefits to taxpayers, including:

- Free Assistance: VITA services are provided at no cost to eligible taxpayers. This ensures that individuals and families with limited financial resources can access professional tax preparation assistance without incurring any additional expenses.

- Accurate Tax Returns: Trained volunteers help ensure that tax returns are prepared accurately and in compliance with current tax laws and regulations. This reduces the risk of errors or omissions that may result in penalties or delays in receiving refunds.

- Access to Tax Credits: Many eligible taxpayers are unaware of the various tax credits they can claim. VITA volunteers inform taxpayers about these credits and help them maximize their deductions, potentially leading to larger refunds.

- Confidentiality and Security: The VITA program maintains strict confidentiality standards to protect taxpayers’ personal and financial information. Volunteers are trained to handle sensitive data securely, giving taxpayers peace of mind.

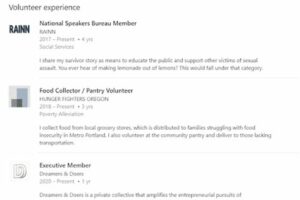

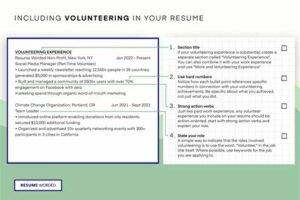

Becoming a VITA Volunteer

The VITA program relies on dedicated volunteers who generously contribute their time and expertise to assist taxpayers. If you have a passion for helping others and want to make a positive impact in your community, you can consider becoming a VITA volunteer. IRS provides training materials and resources to equip volunteers with the necessary skills and knowledge to provide accurate tax preparation assistance. Volunteering with VITA is not only fulfilling but also an excellent opportunity to expand your understanding of the tax system and gain valuable experience in tax preparation.

In Conclusion

The IRS Volunteer Tax Assistance Program, or VITA, is a valuable resource that ensures eligible taxpayers receive professional tax preparation assistance at no cost. With trained volunteers and a commitment to accuracy, the program helps individuals and families with low to moderate incomes, the elderly, persons with disabilities, and limited English-speaking taxpayers fulfill their tax obligations effectively. By availing of the VITA services, taxpayers can benefit from accurate tax returns, access to tax credits, and a greater understanding of their tax responsibilities. The VITA program not only fulfills an essential societal need but also provides an opportunity for individuals to contribute as volunteers and make a positive impact on their communities.

Overview of the IRS Volunteer Tax Assistance Program

The IRS Volunteer Tax Assistance Program (VITA) is a vital initiative that aims to provide free tax help to individuals who need assistance in preparing their tax returns. With the support of trained volunteers, this program ensures that low-income taxpayers, individuals with disabilities, and limited English-speaking individuals receive the guidance they need to navigate the complexities of the tax system.

The Importance of VITA in Promoting Tax Compliance

The VITA program plays a crucial role in promoting tax compliance among taxpayers who might otherwise struggle with understanding their filing obligations. By offering free tax preparation services, VITA enables taxpayers to fulfill their legal obligations accurately, reducing the risk of errors and potential penalties. This ultimately helps to maintain a fair and efficient tax system for all.

How VITA Locations Are Set Up to Serve Taxpayers

VITA locations are strategically set up in easily accessible community centers, libraries, schools, and other convenient locations to ensure that taxpayers can easily avail themselves of the program’s services. These locations are equipped with the necessary technology and resources to assist taxpayers in preparing their tax returns accurately and efficiently. Additionally, VITA volunteers undergo training provided by the IRS and must pass certification exams to ensure they possess the required expertise.

Services Offered by VITA Volunteers

VITA volunteers offer a wide range of services to taxpayers, including preparing and filing tax returns, answering tax-related questions, providing information on tax credits and deductions, and assisting with electronic filing options. Their expertise extends beyond basic tax return preparation, with many volunteers being knowledgeable about specific tax credits and benefits that may apply to certain taxpayers’ unique situations.

Qualification Criteria for Receiving Assistance from VITA

To qualify for assistance from VITA, taxpayers typically have to meet certain income limitations, have disabilities, or require assistance due to limited English proficiency. This ensures that the program’s resources are directed to those who need them the most. VITA volunteers are trained to determine eligibility and provide assistance accordingly, making sure that taxpayers qualify for available deductions and credits.

Benefits of Utilizing the VITA Program

By utilizing the VITA program, taxpayers can save money that would typically be spent on professional tax preparation services. This is especially beneficial for individuals in lower-income brackets who may struggle with the cost of tax preparation. Additionally, the expertise provided by VITA volunteers helps taxpayers avoid costly mistakes and maximize their available tax benefits.

How VITA Promotes Financial Literacy

The VITA program not only assists taxpayers with their immediate tax-related needs but also promotes financial literacy by offering free tax education workshops and one-on-one consultations. These initiatives equip taxpayers with the knowledge and skills needed to manage their finances more effectively and make informed decisions in the future.

How to Locate a VITA Site Near You

To find a VITA site near you, taxpayers can utilize the IRS’s online locator tool, which provides a comprehensive list of VITA locations across the country. Taxpayers can easily search for sites based on their ZIP code and find contact information for scheduling appointments or obtaining more information about the services offered. The online locator tool makes it convenient for taxpayers to access the assistance they need and take advantage of the expertise provided by VITA volunteers.

Point of View: The IRS Volunteer Tax Assistance Program

The IRS Volunteer Tax Assistance Program is an invaluable resource that provides free tax assistance to individuals and families with low to moderate incomes. This program allows certified volunteers to help eligible taxpayers with their tax returns, ensuring they receive the tax credits and deductions they are entitled to.

1. Professionalism and Expertise:

- The IRS Volunteer Tax Assistance Program is staffed by dedicated and knowledgeable volunteers who have undergone rigorous training to become certified tax preparers. Their expertise ensures that taxpayers receive accurate and high-quality assistance.

- These volunteers are well-versed in tax laws and regulations, staying up-to-date with any changes or updates that may affect taxpayers. Their professionalism and attention to detail are essential in helping taxpayers navigate the complexities of the tax system.

2. Accessibility and Affordability:

- One of the key advantages of the IRS Volunteer Tax Assistance Program is its accessibility. By offering free tax assistance, the program ensures that individuals and families with limited financial resources can still receive the help they need to file their taxes accurately.

- This program bridges the gap for those who might not be able to afford professional tax preparation services. It enables taxpayers to access expert assistance without having to spend a significant portion of their income on fees.

3. Personalized Assistance:

- The IRS Volunteer Tax Assistance Program recognizes that each taxpayer’s situation is unique. Volunteers take the time to understand the specific circumstances of each individual or family, giving them personalized attention and tailored guidance.

- Whether it’s understanding deductions and credits, navigating tax forms, or answering questions related to specific tax situations, the volunteers in this program are committed to providing reliable assistance that addresses the specific needs of each taxpayer.

4. Community Impact:

- The IRS Volunteer Tax Assistance Program plays a vital role in strengthening communities by ensuring that every eligible taxpayer can fulfill their tax obligations and receive the benefits they are entitled to.

- By offering free tax assistance, this program helps individuals and families maximize their tax refunds, which can have a direct positive impact on their financial well-being. These refunds can be used to pay bills, reduce debt, or invest in education, thus contributing to the economic growth of local communities.

In conclusion, the IRS Volunteer Tax Assistance Program is a valuable initiative that provides professional, accessible, and personalized tax assistance to low to moderate-income taxpayers. Through its certified volunteers, this program helps individuals and families navigate the complexities of the tax system, ensuring they receive the tax credits and deductions they deserve. By doing so, it contributes to the financial empowerment of taxpayers and strengthens the communities they belong to.

Thank you for visiting our blog and taking the time to learn about the IRS Volunteer Tax Assistance Program. We hope that the information provided has been helpful in shedding light on this valuable initiative aimed at assisting low-income individuals and families with their tax preparation needs.

As we have discussed throughout this article, the IRS Volunteer Tax Assistance Program plays a crucial role in ensuring that everyone has access to quality tax assistance services, regardless of their financial situation. The program relies on dedicated volunteers who generously donate their time and expertise to help those in need. By participating in this program, these volunteers make a significant impact on the lives of individuals and families, helping them navigate the complex world of taxes and maximize their refunds.

If you or someone you know falls within the income guidelines specified by the IRS, we strongly encourage you to take advantage of the IRS Volunteer Tax Assistance Program. Whether it’s by visiting a local VITA site or using the online tools provided by the program, you can benefit from free tax preparation services and ensure that your taxes are filed accurately and on time. Remember, the volunteers involved in this program are trained and certified by the IRS, so you can trust the expertise and professionalism they bring to the table.

In conclusion, the IRS Volunteer Tax Assistance Program serves as a lifeline for many individuals and families who may not have the means to afford professional tax assistance. By leveraging the knowledge and dedication of volunteers, the program aims to alleviate the stress and confusion often associated with tax preparation while ensuring that everyone receives the tax credits and deductions they are entitled to. So, if you qualify for this program, we urge you to explore the available options and take advantage of the support provided. Your participation can make a significant difference in your financial well-being. Thank you once again for visiting our blog, and we wish you all the best in your tax preparation journey!

Video Irs Volunteer Tax Assistance Program

1. What is the IRS Volunteer Tax Assistance Program?

The IRS Volunteer Tax Assistance Program (VITA) is an initiative by the Internal Revenue Service (IRS) to offer free tax help to individuals who generally make $57,000 or less, persons with disabilities, the elderly, and limited English-speaking taxpayers.

2. Is the VITA program reliable?

Yes, the VITA program is a reliable and trustworthy resource for tax assistance. It is administered by IRS-certified volunteers who receive training to help prepare basic tax returns accurately. These volunteers undergo rigorous training and testing to ensure they are well-equipped to assist taxpayers.

3. How can I find a VITA site near me?

To find a VITA site near you, you can use the IRS’s VITA Locator Tool available on their official website. This tool allows you to search for nearby VITA sites by entering your zip code or city and state. It provides you with a list of locations, contact information, and hours of operation.

4. What documents do I need to bring to a VITA site?

When visiting a VITA site, it is important to bring the following documents:

- Social Security cards for yourself, your spouse, and any dependents

- Valid photo identification

- All relevant income statements (W-2 forms, 1099 forms, etc.)

- Receipts, canceled checks, or other documents supporting deductions and credits you are claiming

- A copy of last year’s tax return (if available)

5. Can the VITA program help with complex tax situations?

The VITA program is primarily designed to assist taxpayers with basic tax returns. However, IRS-certified volunteers are trained to handle a wide range of tax situations. If your tax situation is relatively complex, it is advisable to check with the VITA site in advance to ensure they can accommodate your needs.

6. Is there an income limit to qualify for assistance through VITA?

Yes, there is an income limit to qualify for free assistance through VITA. Generally, individuals with an income of $57,000 or less are eligible for the program. However, certain VITA sites may have different income limits, so it is recommended to check with your local site for specific eligibility criteria.

7. Are VITA services available year-round?

VITA services are typically available during the tax filing season, which runs from January through April. However, some VITA sites may offer limited assistance or operate on a year-round basis. It is best to contact your local VITA site to inquire about their availability outside the tax filing season.

8. Can I trust the confidentiality of my information at a VITA site?

Yes, you can trust the confidentiality of your information at a VITA site. All volunteers are required to adhere to strict privacy and security standards set by the IRS. They are trained to protect taxpayer information and are subject to penalties for unauthorized disclosures. You can rest assured that your personal and financial information will be handled with the utmost care.