Table of Contents

Wishing to know if church volunteer work is tax deductible? This article provides insights into the tax implications of volunteering at a church. Understand the criteria for claiming deductions and learn how to navigate the IRS guidelines to potentially maximize your tax benefits as a church volunteer.

Are you a devoted member of your local church community, eager to give back through volunteer work? If so, you may be wondering whether your selfless efforts can actually provide you with some tax benefits. Well, the good news is that the answer is yes! Church volunteer work can indeed be tax deductible, allowing you to contribute to your community while also potentially reducing your overall tax liability. By understanding the guidelines and requirements set forth by the Internal Revenue Service (IRS), you can ensure that your charitable contributions are not only meaningful but also recognized in the eyes of the law.

Is Church Volunteer Work Tax Deductible?

Volunteering at your local church is a noble act that not only helps the community but also provides you with a sense of fulfillment. However, many volunteers wonder if their time and effort can be rewarded financially through tax deductions. In this article, we will explore whether or not church volunteer work is tax deductible.

Understanding Tax Deductions

Before delving into the specifics of church volunteer work, it’s essential to understand what tax deductions are. Tax deductions are expenses or contributions that reduce the amount of income subject to taxation. They can help lower your overall tax liability, potentially resulting in a larger tax refund or a reduced tax payment.

Qualifying Criteria for Tax Deductions

To determine if church volunteer work is tax deductible, we need to look at the qualifying criteria set by the Internal Revenue Service (IRS). According to IRS guidelines, for any expense or contribution to be tax deductible, it must meet the following criteria:

- The expense or contribution must be made to a qualified organization.

- You must itemize your deductions rather than taking the standard deduction.

- You must have proper documentation and receipts to support your claims.

- The expense or contribution must not have any personal benefit or gain attached to it.

Qualified Organizations

To qualify for tax deductions, the volunteer work must be performed for a qualified organization recognized by the IRS. Most churches fall under this category, as long as they meet certain requirements, such as being a religious organization or a nonprofit entity.

Itemizing Deductions

If you want to claim tax deductions for your church volunteer work, you must itemize your deductions instead of taking the standard deduction. Itemizing allows you to list out all your eligible expenses and contributions, including those related to your volunteer activities.

Documentation and Receipts

To support your tax deductions, it is crucial to maintain proper documentation and receipts. This includes records of the hours spent volunteering, any out-of-pocket expenses incurred during volunteer work (such as transportation costs), and receipts for any financial contributions made to the church.

Personal Benefit or Gain

One key criterion for tax deductibility is that the expense or contribution must not have any personal benefit or gain attached to it. If you receive any form of compensation or benefit in return for your church volunteer work, such as free meals or discounted services, it may affect the deductibility of your expenses.

Limits and Restrictions

It’s important to note that there are limits and restrictions on the amount of tax deductions you can claim for volunteer work. The IRS has specific rules regarding the percentage of your income that can be deducted, depending on the type of contribution and your overall income level. It is advisable to consult a tax professional or refer to the IRS guidelines for detailed information.

Other Tax Benefits for Volunteers

While the direct financial benefits of tax deductions for volunteer work may be limited, there are other potential tax benefits available for volunteers. For example, if you use your personal vehicle for volunteer-related travel, you may be eligible to deduct the mileage or actual expenses incurred. Again, proper documentation is essential to support these claims.

Consult a Tax Professional

Given the complexities of tax laws and regulations, it is always wise to consult a tax professional or accountant who can provide personalized advice based on your specific situation. They can guide you through the process of claiming tax deductions for church volunteer work and ensure compliance with all applicable tax regulations.

The Value of Volunteering

While the monetary benefits of tax deductions are undoubtedly attractive, it is important not to overlook the intrinsic value of volunteering itself. The impact your volunteer work has on your community and the personal fulfillment you derive from it often outweigh any potential financial rewards. Remember, the true reward lies in making a positive difference in the lives of others.

In conclusion, church volunteer work can be tax deductible if it meets the qualifying criteria set by the IRS. By understanding these criteria, maintaining proper documentation, and consulting with a tax professional, you can maximize any potential tax benefits while continuing to contribute to your community through your volunteer efforts.

Is Church Volunteer Work Tax Deductible?

Introduction:

When it comes to tax deductions, understanding which expenses can be claimed is crucial for maximizing potential savings. Many individuals engage in volunteer work within their local churches and often wonder if these contributions can be claimed as tax deductions. In this article, we will explore the tax implications of church volunteer work and shed light on whether or not such expenses are tax deductible.

1. Understanding Volunteer Work:

Volunteer work refers to unpaid services offered by individuals for the benefit of others or a specific cause. While volunteering is not typically compensated monetarily, individuals may still be eligible to claim certain deductible expenses incurred during their volunteering activities.

2. General Guidelines for Deductible Expenses:

To be eligible for a tax deduction, volunteer work expenses must meet specific criteria. Generally, these expenses must be incurred solely for the purpose of providing volunteer services, be directly related to the services rendered, and not be reimbursed or reimbursable.

3. Transportation Expenses:

Volunteers who use their personal vehicles for church-related tasks, such as driving to a designated place for service or delivering supplies, may be eligible to claim deductions for transportation expenses. However, it is important to keep accurate records, such as mileage logs, to substantiate the expenses being claimed.

4. Travel Expenses:

If church volunteer work requires individuals to travel away from their local area, they may be able to claim deductions for travel expenses. This can include costs such as airfare, lodging, and meals. However, it is crucial to keep receipts and maintain detailed records to support these deductions.

5. Uniform Expenses:

Certain volunteer roles within a church may require individuals to wear specific uniforms or attire. In such cases, the cost of purchasing, maintaining, or cleaning these uniforms may be deductible. However, it is important to note that regular clothing typically worn in daily life is not eligible for deductions.

6. Training and Education Expenses:

In some instances, church volunteers may be required to attend training sessions or educational programs in order to perform their duties effectively. Expenses incurred for these purposes, such as registration fees or educational materials, may be eligible for tax deductions.

7. Charitable Contributions:

Volunteer work itself is considered a charitable act, and while the actual time and services donated are not tax-deductible, any out-of-pocket expenses directly associated with the volunteer work may be eligible for deduction. Charitable contributions to the church separate from volunteer work may also be tax-deductible, subject to specific IRS guidelines.

8. Documentation and Record-Keeping:

To ensure smooth tax filing and substantiation of claims, it is essential for individuals engaged in church volunteer work to maintain accurate records of expenses incurred. This includes keeping receipts, mileage logs, and any other relevant documents to support their deductions.

Conclusion:

While church volunteer work itself is not directly tax-deductible, various expenses incurred during the course of these activities may be eligible for deductions. From transportation and travel expenses to uniform and training costs, it is important to understand the specific IRS guidelines surrounding deductible volunteer work expenses. Keeping accurate records is vital to support these deductions and maximize potential tax savings. It is always advisable to consult with a tax professional to ensure compliance with current tax laws and regulations.

Is Church Volunteer Work Tax Deductible?

In the United States, many individuals engage in volunteer work to support their local communities and contribute to causes they believe in. One popular form of volunteering is through church organizations, where individuals dedicate their time and skills to various activities and initiatives. However, when it comes to tax deductions, the question arises: Is church volunteer work tax deductible? Let’s explore this topic further.

1. General rule:

- According to the Internal Revenue Service (IRS), volunteer work, including church-related activities, cannot be deducted as a charitable contribution on your income tax return.

- This is because the IRS does not consider the value of your time or services as a deductible expense.

2. Exceptions:

- While the general rule states that volunteer work is not tax deductible, there are some exceptions and specific situations where you might be eligible for deductions:

- Out-of-pocket expenses: If you incur expenses directly related to your church volunteer work, such as buying materials or supplies, you may be able to deduct these expenses on your tax return.

- Mileage deduction: If you use your personal vehicle for church volunteer work, you can usually deduct the mileage driven at the standard charitable rate set by the IRS.

- Travel expenses: In some cases, if your church volunteer work requires you to travel away from home overnight, you may be able to deduct certain travel expenses, such as transportation and lodging.

3. Documentation and record-keeping:

- To claim deductions for out-of-pocket expenses or mileage, it is crucial to maintain detailed records and documentation.

- Keep track of receipts, invoices, and any other relevant proof of expenses incurred during your volunteer work.

- Maintain a logbook recording the dates, locations, and mileage driven for each church-related activity.

4. Consult a tax professional:

- Determining the tax deductibility of church volunteer work can be complex, as it depends on various factors and individual circumstances.

- To ensure accurate and compliant reporting, it is advisable to consult a qualified tax professional who can provide personalized advice and guidance based on your specific situation.

- A tax professional can help you understand the potential deductions you may be eligible for and assist in maximizing your tax benefits.

Conclusion:

While church volunteer work itself is not tax deductible, exceptions exist for certain expenses such as out-of-pocket costs, mileage, and travel expenses. It is essential to maintain proper documentation and consult a tax professional to ensure compliance with IRS regulations and take advantage of any available deductions. By doing so, you can support your church community while potentially benefiting from tax savings within the limits set by the IRS.

Thank you for taking the time to visit our blog and read about the topic of whether church volunteer work is tax deductible. We understand that this can be a complex and often confusing issue, so we hope that the information we have provided has been helpful in clearing up any uncertainties you may have had.

Throughout the article, we have discussed the general guidelines surrounding tax deductions for volunteer work, and specifically addressed how they apply to church-related activities. We have emphasized the importance of understanding the specific requirements set forth by the Internal Revenue Service (IRS) to ensure that you are eligible for any potential tax benefits.

It is crucial to note that while church volunteer work itself typically does not qualify as a tax deduction, certain expenses incurred during the course of your service may be eligible. These expenses could include the cost of transportation, supplies, or other out-of-pocket expenditures directly related to your volunteer work. However, it is essential to keep detailed records and consult with a tax professional to ensure that you are following the correct procedures and documenting your expenses properly.

In conclusion, we want to emphasize the importance of seeking professional advice when it comes to determining the tax deductibility of your church volunteer work. While we have provided some general information in this article, every individual’s situation is unique, and tax laws can be complex. Consulting with a qualified tax professional will help ensure that you maximize any potential tax benefits while staying compliant with IRS regulations.

We hope that this blog post has given you a better understanding of the topic and has provided a starting point for further research or discussion. Remember, the information provided here is not intended to substitute professional advice, and we encourage you to reach out to a tax professional for personalized guidance. Thank you again for visiting our blog, and we wish you all the best in your future endeavors.

Video Is Church Volunteer Work Tax Deductible

People also ask about: Is Church Volunteer Work Tax Deductible?

Can I deduct church volunteer work on my taxes?

What documentation do I need to claim tax deductions for church volunteer work?

Are there any limitations on the amount I can deduct for church volunteer work?

Can I deduct the cost of uniforms or supplies purchased for church volunteer work?

Is there a minimum number of hours required for church volunteer work to be tax deductible?

Yes, you may be able to deduct expenses incurred while performing volunteer work for a church. However, it is important to note that only certain types of expenses are eligible for tax deductions. These expenses typically include unreimbursed travel expenses, such as mileage, parking fees, and tolls, directly related to your volunteer work. It is recommended to consult with a tax professional or refer to the IRS guidelines to determine which expenses qualify for deduction.

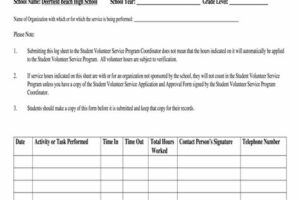

In order to claim tax deductions for church volunteer work, it is crucial to maintain proper documentation. This documentation should include records of your volunteer activities, such as dates, times, and the nature of the work performed. Additionally, keep track of any out-of-pocket expenses you incur during your volunteer work, including receipts for transportation costs. Having organized and detailed records will help support your claim for tax deductions, if necessary.

Yes, there are limitations on the amount you can deduct for church volunteer work. The deductible amount is generally limited to the actual expenses you incurred while performing volunteer services. It is important to keep in mind that you cannot deduct the value of your time or services provided. Additionally, the total amount of your deductions, including those for volunteer work, must not exceed your total income for the year. Consult with a tax professional to ensure you understand the specific limitations and requirements applicable to your situation.

Yes, you may be able to deduct the cost of uniforms or supplies purchased specifically for church volunteer work. These expenses are generally considered as unreimbursed business expenses and may be eligible for tax deductions. However, it is important to note that the expenses must be necessary and exclusively used for your volunteer work at the church. Keep detailed records and receipts to support your claim for these deductions and consult with a tax professional for guidance on specific eligibility requirements.

No, there is no specific minimum number of hours required for church volunteer work to be tax deductible. The IRS does not set a minimum threshold for deductibility based on the number of hours volunteered. However, it is essential to ensure that your volunteer work is performed for a qualified charitable organization, such as a church, and that the expenses you intend to deduct meet the applicable criteria set by the IRS. Consulting with a tax professional can help you determine your eligibility for deductions based on your individual circumstances.