Table of Contents

The Community Volunteer Income Tax Program (CVITP) is a volunteer-based initiative aimed at assisting low-income individuals and families in preparing their income tax returns. This program provides free tax preparation services and ensures that eligible taxpayers receive all the benefits and credits they are entitled to. Join the CVITP today to make a difference in your community!

The Community Volunteer Income Tax Program is an invaluable initiative that aims to provide assistance and support to individuals in need of help with their taxes. This program, organized by dedicated volunteers, offers a range of services that not only simplify the often overwhelming process of filing taxes but also ensure that eligible individuals receive all the benefits and credits they are entitled to. With the tax season just around the corner, it is important to highlight the remarkable impact that the Community Volunteer Income Tax Program has had on countless individuals and families across our community.

The Importance of the Community Volunteer Income Tax Program

The Community Volunteer Income Tax Program (CVITP) is an essential initiative that provides assistance to individuals with low income and simple tax situations. Through this program, community volunteers offer their time and expertise to help eligible individuals complete and file their income tax returns accurately and efficiently. This article aims to highlight the significance of the CVITP and the benefits it brings to both volunteers and the communities they serve.

Eligibility Criteria

The CVITP primarily targets individuals who have a modest income and a straightforward tax situation. These can include seniors, newcomers to Canada, individuals with disabilities, and those receiving social assistance. By focusing on these groups, the program aims to ensure that those who need assistance the most receive the support they require to navigate the complexities of the tax system.

Benefits of Using the CVITP

The Community Volunteer Income Tax Program offers numerous advantages to eligible individuals. Firstly, it provides access to free tax preparation services, which can be particularly beneficial for those who may not have the financial means to hire professional assistance. Additionally, volunteers are trained by the Canada Revenue Agency (CRA), ensuring that participants receive accurate and reliable guidance throughout the tax filing process.

Flexibility and Convenience

One of the key advantages of the CVITP is the flexibility and convenience it offers to participants. Volunteers are often available at various locations within the community, such as community centers, libraries, or local organizations. This ensures that individuals can access assistance in their own neighborhoods, eliminating the need for long commutes or travel expenses.

Building Stronger Communities

By engaging in the CVITP, volunteers play a vital role in strengthening their communities. The program fosters a sense of connection and support within neighborhoods, as community members come together to help one another. These dedicated volunteers contribute their expertise, time, and resources to assist individuals who may otherwise struggle with their taxes, creating a more inclusive and supportive environment for everyone.

Developing Skills and Experience

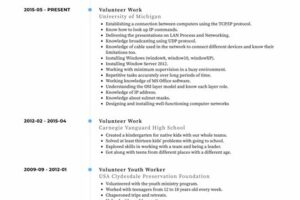

The CVITP provides an excellent opportunity for volunteers to develop valuable skills and gain experience in tax preparation. Through their involvement in the program, volunteers receive training from the CRA, enhancing their knowledge of the tax system and enabling them to assist others effectively. These acquired skills can be highly beneficial for future career prospects or personal growth.

The CVITP and Digital Inclusion

While the world becomes increasingly digital, it is important not to overlook individuals who may have limited access to technology or face difficulties navigating online systems. The CVITP helps bridge this digital divide by providing in-person assistance to those who may not have the means or comfort level to file their taxes online. This ensures that everyone has equal access to tax benefits and services.

Contributing to Government Revenues

By assisting individuals with their tax returns, the CVITP plays a significant role in ensuring that all eligible individuals contribute to government revenues. The program aims to increase overall tax compliance by helping individuals fulfill their tax obligations accurately and on time. This, in turn, supports government initiatives and programs that benefit the entire community.

Recognizing Volunteers

The CVITP would not be possible without the dedicated volunteers who selflessly offer their time and expertise. Recognizing these individuals is crucial to acknowledging their invaluable contribution to the community. Various recognition initiatives exist to honor the outstanding efforts of CVITP volunteers, highlighting their commitment and inspiring others to get involved.

Getting Involved

If you are interested in making a difference in your community and have a passion for helping others, consider getting involved in the Community Volunteer Income Tax Program. By becoming a volunteer, you can contribute to building stronger communities, develop valuable skills, and support individuals who may be in need of assistance during tax season. Contact your local CVITP organization or visit the Canada Revenue Agency’s website for more information on how to get started.

The Community Volunteer Income Tax Program is a remarkable initiative that brings together individuals from diverse backgrounds to support one another and ensure equitable access to tax services. By recognizing the importance of this program and the impact it has on communities, we can foster an environment of inclusivity and empowerment for all.

Overview of the Community Volunteer Income Tax Program

The Community Volunteer Income Tax Program (CVITP) is an initiative led by the Government of Canada that aims to assist low-income individuals and families in preparing their tax returns. By accessing the services of trained community volunteers, individuals can meet their tax obligations and access benefits and credits they are entitled to.

Purpose and Objectives

The purpose of the CVITP is to provide free tax preparation assistance to individuals with modest income and a simple tax situation. The program aims to ensure that eligible taxpayers can fulfill their tax obligations accurately while maximizing their benefits and credits. By offering free tax clinics staffed by dedicated volunteers, the CVITP aims to reduce the financial burden on low-income individuals and promote financial well-being.

Eligibility and Accessibility

The CVITP is available to individuals with modest income and a simple tax situation. This includes newcomers to Canada, seniors, and students. The program is designed to help those who may not have the financial resources or knowledge to navigate the tax system on their own. To ensure accessibility, CVITP tax clinics are strategically located in community organizations, making it easier for eligible taxpayers to access the assistance they need.

Role of Volunteers

The success of the CVITP heavily relies on the commitment and involvement of volunteers. These individuals undergo comprehensive training and certification provided by the Canada Revenue Agency (CRA) to ensure they can provide accurate and ethical tax services. Volunteers play a crucial role in assisting eligible taxpayers in completing their returns, ensuring compliance with tax laws and regulations while maximizing benefits and credits.

Benefits and Impact of the CVITP

Access to Benefits and Credits

One of the key benefits of the CVITP is that it facilitates the process of accessing various government benefits and credits for eligible individuals. By completing their tax returns through the program, individuals can claim refunds they are entitled to, such as the Goods and Services Tax/Harmonized Sales Tax (GST/HST) credit, the Canada Child Benefit (CCB), and various provincial and territorial credits. This not only helps individuals financially but also ensures they receive the support they need.

Financial Empowerment and Advocacy

The CVITP plays a critical role in promoting financial literacy and empowerment among vulnerable populations. By helping individuals become more informed about their tax obligations, volunteers contribute to their overall financial well-being and strengthen their ability to advocate for themselves in matters related to taxation. This empowerment allows individuals to make informed decisions and take control of their financial futures.

Community Engagement and Collaboration

The CVITP fosters community engagement and collaboration by bringing together individuals, social service organizations, and community groups. Through partnerships with local organizations, tax clinics are set up in convenient and trusted locations, creating opportunities for volunteers to actively engage with their communities and build lasting relationships. This collaboration strengthens community ties and ensures that individuals receive the support they need in a welcoming and accessible environment.

How to Volunteer with the CVITP

Application and Training

Individuals interested in volunteering with the CVITP can apply through the CRA’s website or by contacting their local community organization hosting a tax clinic. Once selected, volunteers undergo comprehensive training provided by the CRA, which equips them with the necessary knowledge and skills to assist taxpayers accurately. This training ensures that volunteers are prepared to provide high-quality tax services.

Responsibilities and Commitment

CVITP volunteers are committed to providing high-quality tax services while adhering to ethical principles and maintaining taxpayer confidentiality. Volunteers may be required to commit a certain number of hours per week during the tax season, ensuring that taxpayers receive the support they need within established timeframes. This commitment ensures that the program runs smoothly and effectively.

Personal and Professional Development

Volunteering with the CVITP offers numerous opportunities for personal and professional growth. Volunteers gain valuable experience in tax preparation, enhancing their communication and problem-solving skills. Additionally, volunteers contribute to the well-being of their communities by providing crucial assistance to those in need. The CVITP also provides recognition and certificates to acknowledge volunteers’ commitment and achievements, further supporting their personal and professional development.

Point of View: Community Volunteer Income Tax Program

As a professional in the field of taxation, I firmly believe in the importance and effectiveness of the Community Volunteer Income Tax Program (CVITP). This program plays a crucial role in helping individuals and families with low income to access quality tax services and maximize their tax benefits. Here are some key points highlighting why the CVITP is a valuable initiative:

- Accessible and Convenient: The CVITP ensures that individuals who may not have the means or resources to hire professional tax preparers can still benefit from accurate and reliable tax assistance. By offering free tax clinics at various community locations, the program makes it convenient for eligible individuals to receive the help they need.

- Expertise and Knowledge: The volunteers involved in the CVITP undergo comprehensive training and certification. Their expertise and knowledge enable them to provide accurate tax preparation services, ensuring that eligible individuals claim all the deductions, credits, and benefits they are entitled to.

- Confidentiality and Trust: The CVITP maintains strict confidentiality standards, ensuring that sensitive personal and financial information shared by individuals seeking assistance remains secure. This commitment to privacy helps build trust within the community and encourages individuals to take advantage of the program without any hesitation or concerns.

- Empowering Individuals and Communities: By providing assistance with tax preparation, the CVITP empowers individuals and communities to take control of their financial well-being. Accurate tax filing can lead to increased refunds, which can be used to support essential needs, education, and other important aspects of life.

- Collaboration and Partnerships: The success of the CVITP is rooted in the collaboration between the Canada Revenue Agency (CRA) and community organizations. Through partnerships with local agencies, the program reaches out to those who would benefit the most, ensuring that eligible individuals have access to the services they need.

- Reducing Tax Compliance Issues: The CVITP not only assists individuals in filing their taxes accurately, but it also helps reduce tax compliance issues within low-income communities. By providing reliable tax services, the program contributes to overall tax compliance, strengthening the integrity of the tax system.

In conclusion, the Community Volunteer Income Tax Program is a commendable initiative that brings together dedicated volunteers, community organizations, and the CRA to support individuals and families with low income. By providing accessible and expert tax assistance, the program empowers individuals, reduces compliance issues, and contributes to the financial well-being of communities. The impact of the CVITP on improving tax literacy and maximizing tax benefits cannot be overstated, making it an invaluable resource for those who need it most.

Thank you for visiting our blog and taking the time to learn about the Community Volunteer Income Tax Program (CVITP). We hope that this article has provided you with valuable information about this important initiative and its impact on our community. As a volunteer-driven program, we rely on the generosity and dedication of individuals like you to make a difference in the lives of low-income individuals and families.

The CVITP plays a crucial role in ensuring that everyone has access to the resources they need to file their taxes accurately and efficiently. By offering free tax preparation services to those who may not be able to afford professional help, we strive to alleviate financial stress and empower individuals to claim the benefits and credits they are entitled to. Taxes can be complex and overwhelming, especially for those with limited resources, and our dedicated volunteers are here to simplify the process and provide support every step of the way.

Volunteering with the CVITP is not only an opportunity to contribute to your community but also a chance to gain valuable skills and experiences. As a volunteer tax preparer, you will receive training and support from our experienced team, allowing you to develop expertise in tax preparation and enhance your resume. Furthermore, by engaging with clients from diverse backgrounds, you will have the chance to broaden your horizons and foster meaningful connections within your community.

We encourage you to consider joining the CVITP as a volunteer or spreading the word about our services to those in need. Together, we can make a lasting impact on the lives of individuals and families in our community. Whether you have a background in finance or simply have a passion for helping others, there is a place for you in our program. Reach out to us today to learn more about how you can get involved and make a difference through the Community Volunteer Income Tax Program.

Thank you once again for visiting our blog, and we hope to welcome you as a valued member of our volunteer team or assist you with your tax preparation needs in the near future. Together, we can build a stronger and more inclusive community by empowering individuals through financial literacy and support.

Video Community Volunteer Income Tax Program

People Also Ask about Community Volunteer Income Tax Program:

What is the Community Volunteer Income Tax Program (CVITP)?

Who is eligible for the CVITP?

How can I find a CVITP volunteer near me?

What documents do I need to bring to a CVITP tax clinic?

Can CVITP volunteers help me with complex tax situations?

Is there a fee for using the CVITP services?

The Community Volunteer Income Tax Program (CVITP) is a program offered by the Government of Canada to help eligible individuals and families with low income file their taxes for free. It is run by volunteers who are trained to provide assistance in completing tax returns.

The CVITP is available to individuals and families with modest income and a simple tax situation. Generally, this program caters to individuals who earn less than a certain threshold and have no business income or rental properties. Eligibility criteria may vary depending on the region, so it is advisable to check with the local CVITP office.

You can find a CVITP volunteer near you by using the Find a tax clinic tool on the Canada Revenue Agency (CRA) website. This tool allows you to search for volunteer tax clinics in your area based on your postal code or city.

When visiting a CVITP tax clinic, it is important to bring all relevant documents related to your income, expenses, and deductions. This may include T-slips, receipts, proof of rent, medical expenses, and other supporting documents. It is recommended to review the CRA’s checklist of required documents before attending the clinic.

No, CVITP volunteers are trained to assist individuals with simple tax situations. If you have a complex tax situation involving business income, rental properties, capital gains, or other intricate matters, it is advisable to seek professional assistance from a tax accountant or tax lawyer.

No, the CVITP services are provided free of charge. The volunteers offer their time and expertise on a voluntary basis to help individuals and families with low income file their taxes without incurring any fees.