Table of Contents

Discover how you can benefit from tax breaks for your volunteer work. Learn about the eligibility criteria and deductions available for volunteers, providing necessary services to nonprofits and charitable organizations. Maximize your impact by understanding the tax incentives that reward your dedication and effort. Find out how your volunteer work can make a difference not only in the community but also in your own finances.

Volunteering is a noble act that not only benefits society but also brings personal fulfillment and a sense of purpose. However, did you know that in addition to making a positive impact on the lives of others, volunteering can also provide tax benefits? Yes, that’s right! The government recognizes the importance of volunteer work and offers tax breaks as an incentive for individuals to contribute their time and skills. So, if you are passionate about giving back to your community and want to maximize the impact of your efforts, understanding the tax advantages of volunteer work is essential. In this article, we will explore how these tax breaks work and how you can take advantage of them to make a difference while also saving money.

The Importance of Volunteer Work

Volunteer work plays a crucial role in society, providing much-needed support and assistance to various charitable organizations, community projects, and social causes. From helping the less fortunate to promoting environmental conservation, volunteers devote their time and skills to create positive change. Recognizing the significance of volunteer work, many governments offer tax incentives to encourage individuals to engage in such activities.

Understanding Tax Breaks for Volunteer Work

Tax breaks for volunteer work are financial incentives provided by the government to individuals who dedicate their time and services to eligible nonprofit organizations. These tax benefits are designed to recognize the value of volunteering and offset some of the costs associated with it. Depending on the country and specific regulations, tax breaks may include deductions, exemptions, or credits that can lower an individual’s taxable income or reduce their overall tax liability.

Eligibility Criteria

In order to qualify for tax breaks related to volunteer work, individuals must meet certain eligibility criteria. Typically, this involves volunteering for a registered nonprofit organization or a recognized charitable entity. The volunteer work should be unpaid and performed willingly. Additionally, individuals may need to meet minimum service hour requirements or fulfill specific roles outlined by the organization.

Deducting Travel Expenses

One common tax break available to volunteers is the ability to deduct travel expenses incurred while engaged in volunteer work. This could include the cost of transportation, meals, and accommodation. However, it’s important to note that these deductions are usually limited to unreimbursed expenses directly related to volunteer work and not personal travel expenses.

Claiming Charitable Contributions

Volunteers who make monetary or in-kind contributions to the organizations they serve may also be eligible for tax deductions. These deductions apply to cash donations, as well as the fair market value of donated goods or services. However, volunteers should keep proper documentation, such as receipts or acknowledgment letters from the organization, to support their claims.

Exempting Income from Volunteer Stipends

In some cases, volunteers may receive small stipends or reimbursements for their time and expenses. These amounts are typically considered taxable income. However, certain jurisdictions provide exemptions for volunteer stipends up to a specific limit. By excluding these stipends from their taxable income, volunteers can reduce their overall tax burden.

Tax Credits for Volunteer Work

While deductions and exemptions reduce the amount of taxable income, tax credits directly reduce the tax liability itself. Some countries offer tax credits specifically for volunteer work, allowing individuals to subtract the credit amount directly from the taxes owed. This serves as a more significant financial benefit compared to deductions or exemptions.

Documentation and Record-Keeping

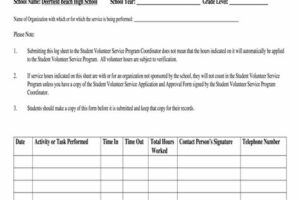

In order to claim tax breaks for volunteer work, it is crucial to maintain detailed records of all relevant activities and expenses. This includes documenting the hours spent volunteering, the nature of the work performed, and any associated costs. Proper record-keeping ensures that individuals have the necessary evidence to support their claims and maximize their tax benefits.

Consulting Tax Professionals

Navigating the complexities of tax regulations can be challenging, especially when it comes to claiming tax breaks for volunteer work. It is highly recommended for volunteers to seek the guidance of tax professionals or certified accountants who specialize in nonprofit tax matters. These experts can provide personalized advice, help ensure compliance with tax laws, and optimize the available tax benefits.

Encouraging Volunteerism Through Tax Incentives

By offering tax breaks for volunteer work, governments aim to incentivize individuals to actively participate in community service and charitable activities. These incentives not only benefit the volunteers themselves by reducing their tax burden, but they also contribute to the overall betterment of society. Recognizing the invaluable contributions of volunteers fosters a culture of giving back, ultimately leading to stronger and more compassionate communities.

The Rewards of Volunteering

While tax breaks can provide financial benefits, the true rewards of volunteering extend far beyond monetary incentives. Engaging in volunteer work allows individuals to make a positive impact, connect with their communities, develop new skills, and gain a sense of fulfillment. The value of giving back to society cannot be understated, and tax breaks serve as a small token of appreciation for those who selflessly dedicate their time and efforts to make a difference.

Importance of Volunteer Work in Society

Volunteer work plays a crucial role in society by providing essential services and support to various organizations and communities. It promotes empathy, compassion, and social responsibility among individuals. Recognizing the significant impact of volunteerism, tax breaks are offered to encourage and reward individuals for their charitable contributions.

Types of Volunteer Activities Eligible for Tax Breaks

Tax breaks are available for a wide range of volunteer activities, including but not limited to working with nonprofit organizations, schools, hospitals, religious institutions, and community development projects. Whether it involves mentoring, tutoring, providing healthcare services, participating in disaster relief efforts, or assisting in cultural events, individuals may be entitled to tax benefits for their dedicated efforts.

Monetary Value of Tax Breaks

Tax breaks for volunteer work can provide individuals with financial relief by reducing their taxable income or allowing deductible expenses on their tax returns. The monetary value of these tax breaks can vary depending on the country and specific tax laws. It is advisable to consult with a tax professional or refer to official government guidelines to determine the exact benefits available in your jurisdiction.

Documentation and Eligibility Requirements

To claim tax breaks for volunteer work, individuals typically need to maintain proper documentation proving their contribution. This may include letters of recognition, timesheets, receipts for expenses, or other official records provided by the organization or project coordinator. Eligibility requirements may also differ, such as minimum hours of service or specific qualifications, so it is important to understand and fulfill these criteria to ensure eligibility for tax breaks.

Volunteer Work and Non-Cash Contributions

In addition to tax breaks for monetary donations, individuals who make non-cash contributions through volunteer work may also be eligible for certain tax benefits. This can include the deduction of expenses related to travel, materials, or equipment used during volunteer activities. However, it is essential to follow the guidelines and substantiation requirements set by tax authorities to claim these deductions accurately.

Active vs. Passive Volunteer Work

When assessing tax breaks for volunteer work, it is important to understand the distinction between active and passive contributions. Active volunteer work generally requires a direct and significant involvement in the organization’s activities, while passive contributions may involve serving on boards or committees. Tax benefits are typically more commonly associated with active volunteer work where individuals actively contribute their time and skills.

Benefits Beyond Tax Breaks

While tax breaks provide a financial incentive for volunteering, the benefits of volunteer work extend far beyond monetary rewards. Engaging in volunteer activities offers opportunities for personal growth, skill development, and networking. It allows individuals to make a positive impact on their communities, enhance their resumes, and develop a sense of fulfillment and purpose.

Seeking Professional Advice and Staying Updated

Tax laws and regulations surrounding volunteer work can be complex and vary from one jurisdiction to another. To ensure you maximize the tax benefits available for your volunteer efforts, it is crucial to seek advice from tax professionals or consult official resources provided by tax authorities. Staying updated with current tax laws, deductions, and filing requirements will help individuals make the most informed decisions when claiming tax breaks for their volunteer work.

Point of view: Tax Breaks for Volunteer Work

Tax incentives for volunteer work can serve as a powerful tool to encourage individuals to actively participate in community service and contribute to the betterment of society.

By providing tax breaks, the government acknowledges and appreciates the valuable contributions made by volunteers, which helps foster a culture of volunteering and altruism.

Volunteer work plays a pivotal role in addressing social issues and meeting the needs of vulnerable populations. Offering tax benefits can attract more individuals to engage in such activities, thereby amplifying the impact of their efforts.

With tax breaks, individuals who may have hesitated due to financial concerns or time constraints are more likely to participate in volunteer work, as they can offset some of the costs associated with their contribution.

Providing tax benefits for volunteer work can lead to increased volunteer recruitment and retention rates for nonprofit organizations, as it incentivizes potential volunteers to dedicate their time and skills to support these organizations’ missions.

Encouraging volunteerism through tax breaks not only benefits individuals and organizations but also has a positive ripple effect on society as a whole. It fosters a sense of community, boosts civic engagement, and strengthens social cohesion.

By offering tax incentives, the government indirectly invests in the well-being of its citizens and communities. Volunteers often address gaps in social services, reducing the burden on public resources and contributing to the overall welfare of society.

Implementing tax breaks for volunteer work aligns with the principles of fairness and equity. It acknowledges the value of non-monetary contributions and provides a tangible benefit to individuals who choose to give their time and skills to support important causes.

Tax incentives for volunteer work can also have positive economic effects. They can stimulate local economies by encouraging individuals to engage in community activities, leading to increased spending on goods and services within the area.

Overall, tax breaks for volunteer work act as a catalyst for social change, promoting a more engaged and compassionate society. They recognize the importance of volunteerism and empower individuals to make a difference in their communities while enjoying some financial relief.

Thank you for visiting our blog and taking the time to learn more about the tax breaks available for volunteer work. We hope that the information provided has been helpful and informative, shedding light on the potential financial benefits that can be gained from giving back to your community.

Volunteering is not only a selfless act that contributes to the betterment of society, but it can also provide individuals with valuable tax deductions. These deductions can help offset some of the costs associated with volunteering, such as transportation expenses or the purchase of necessary supplies. By taking advantage of these tax breaks, individuals can maximize the impact of their volunteer efforts while also easing the burden on their own wallets.

One important thing to keep in mind is that not all volunteer work qualifies for tax deductions. In order to be eligible, the organization you volunteer for must have a recognized tax-exempt status. This means that they are registered as a nonprofit organization with the IRS. Additionally, any expenses you wish to deduct must be directly related to your volunteer work and not reimbursed by the organization. It is always advisable to consult with a tax professional or refer to the IRS guidelines to ensure compliance with the specific requirements and limitations.

In conclusion, while the primary motivation behind volunteering is often driven by a desire to make a positive impact, it is worth considering the potential tax benefits that can come along with it. By exploring the available tax breaks for volunteer work, individuals can not only contribute to causes they are passionate about but also enjoy some relief on their tax bill. We encourage you to take advantage of these opportunities and continue making a difference in your community through your dedicated volunteer efforts. Thank you again for visiting our blog, and we hope that you found the information provided to be valuable.

.

People Also Ask About Tax Break for Volunteer Work:

1. Can I claim a tax break for volunteer work?

Yes, you may be eligible to claim certain expenses related to volunteer work as tax deductions. However, it is important to note that you cannot deduct the value of your time or services as a volunteer.

2. What types of expenses can be claimed as tax deductions for volunteer work?

You can claim out-of-pocket expenses directly related to your volunteer work, such as transportation costs (e.g., mileage or public transportation fares), supplies and materials used for volunteering, and certain uniform expenses. These expenses must be incurred solely for your volunteer activities and should not be reimbursed by any organization.

3. Are there any limitations or restrictions on claiming tax deductions for volunteer work?

Yes, there are certain limitations and restrictions when claiming tax deductions for volunteer work. For example, you cannot claim deductions for expenses that have been reimbursed to you or for which you have received any kind of payment or compensation. Additionally, you must keep proper documentation and receipts to substantiate your expenses.

4. How do I claim tax deductions for volunteer work?

To claim tax deductions for volunteer work, you will need to itemize your deductions on Schedule A of your tax return using Form 1040. Keep accurate records of your expenses, including receipts, mileage logs, and any other relevant documentation to support your claims.

5. Are there any specific requirements I need to meet to qualify for tax deductions for volunteer work?

Yes, in order to qualify for tax deductions for volunteer work, you generally need to be volunteering for a qualified charitable organization, religious group, or government entity. Additionally, you should have incurred legitimate expenses that are directly related to your volunteer activities.

Remember, it is always a good idea to consult with a tax professional or utilize tax software to ensure you are accurately claiming any tax breaks for volunteer work and complying with all applicable tax laws and regulations.