Table of Contents

Learn about the tax implications of paid volunteer work. Find out if the income earned from these positions is taxable and what reporting requirements you may have. Understand the potential deductions and exemptions available for paid volunteers to ensure compliance with tax laws.

Are you considering volunteering your time for a cause you are passionate about? That’s commendable! However, before you dive into the world of volunteer work, it is important to understand the potential tax implications. Many people wonder if paid volunteer work is taxable or not. In this article, we will explore this question and shed light on whether the rewards you receive for your hard work could potentially come with a tax bill attached. So, let’s delve into the realm of taxes and volunteer work to gain a clear understanding of how your efforts may impact your financial obligations to the government.

Introduction

Volunteering is a noble act that many individuals engage in to make a positive difference in their communities or support causes they believe in. While most volunteer work is unpaid, there are instances where individuals receive compensation for their services. In such cases, it is important to consider the tax implications of paid volunteer work and whether it is taxable. This article will explore this topic and provide insights into the taxation of paid volunteer work.

Understanding Paid Volunteer Work

Before delving into the taxation aspect, it is crucial to define what constitutes paid volunteer work. Paid volunteer work refers to situations where volunteers receive financial compensation for their services. This compensation can come in the form of wages, stipends, or other financial benefits provided by the organization or entity they are volunteering for.

When is Paid Volunteer Work Taxable?

In general, any income received by individuals is subject to taxation. However, the taxability of paid volunteer work depends on various factors, including the nature of the organization, the type of work performed, and the purpose of the compensation. Let’s explore these factors in more detail:

1. Nonprofit Organizations

If you are engaged in paid volunteer work for a nonprofit organization, the compensation is generally taxable. Nonprofit organizations, despite their tax-exempt status, are still required to report wages and provide necessary tax documents to volunteers. This means that you may be required to include the income earned from paid volunteering on your tax return.

2. Government Entities

Volunteering for government entities, such as local or state agencies, can also result in taxable compensation. Similar to nonprofit organizations, government entities are subject to tax laws, and any compensation received for volunteer work is typically considered taxable income.

3. For-Profit Organizations

In the case of paid volunteer work for for-profit organizations, the compensation is almost always taxable. For-profit entities operate with the primary goal of making a profit, and any financial benefits provided to volunteers are treated as regular wages subject to taxation.

Possible Tax Exemptions

While paid volunteer work is generally taxable, there are certain situations where exemptions may apply. These exemptions could reduce or eliminate the tax liability associated with the compensation received. Some potential tax exemptions related to paid volunteer work include:

1. Reimbursement of Expenses

If the compensation received for paid volunteer work is solely reimbursement for out-of-pocket expenses, it may not be taxable. Reimbursements for expenses incurred directly related to the volunteer work, such as travel costs or supplies, are generally not considered taxable income.

2. De Minimis Benefits

In certain cases, if the value of the compensation received is considered de minimis, it may not be subject to taxation. De minimis benefits refer to small, inconsequential benefits that are difficult to measure and administer. The IRS provides guidelines on what can be categorized as de minimis benefits for tax purposes.

3. Volunteer Work for Qualified Charitable Organizations

Volunteering for qualified charitable organizations can potentially provide tax benefits. In some cases, the compensation received for volunteer work may qualify for specific deductions or credits, reducing the overall tax liability associated with the income. However, it is essential to consult with a tax professional or review IRS guidelines to fully understand the eligibility criteria and requirements for these deductions or credits.

Reporting Paid Volunteer Work Income

When paid volunteer work is taxable, it is important to accurately report the income on your tax return. Failing to report taxable income can lead to penalties and potential legal consequences. Here are some key points to consider when reporting paid volunteer work income:

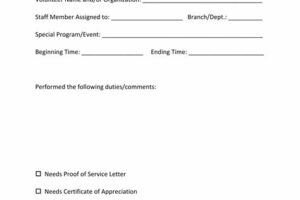

1. Obtain Necessary Tax Documents

Ensure that you receive the necessary tax documents from the organization or entity providing the compensation. This could include a W-2 form, 1099 form, or any other relevant documentation detailing your earnings.

2. Keep Detailed Records

Maintain accurate records of your paid volunteer work, including dates, hours worked, tasks performed, and any expenses incurred. These records will be valuable when preparing your tax return and supporting your income reporting.

3. Consult with a Tax Professional

If you are uncertain about the tax implications of your paid volunteer work or need assistance with reporting, it is advisable to consult with a tax professional. They can provide personalized guidance based on your specific situation and ensure compliance with relevant tax laws.

Conclusion

Paid volunteer work can be a rewarding experience, both personally and financially. However, it is important to understand the tax implications associated with such compensation. While paid volunteer work is generally taxable, exemptions may apply in certain circumstances. It is crucial to consult with a tax professional or refer to IRS guidelines to determine the taxability of your specific situation and accurately report any earned income from paid volunteer work.

Is Paid Volunteer Work Taxable?

As governments worldwide grapple with funding shortages for social programs, the concept of paid volunteer work has gained traction. This innovative approach allows individuals to receive compensation for their time and effort while still contributing to important causes. However, the question of whether this income should be subject to taxation arises. In this article, we will explore the tax implications of paid volunteer work and shed light on this important topic.

1. Understanding Paid Volunteer Work

Paid volunteer work refers to a form of employment where individuals receive monetary compensation for their services in nonprofit organizations or government agencies. It is a unique approach that aims to provide financial support to individuals while allowing them to engage in activities that benefit society.

2. Differentiating Paid Volunteer Work from Regular Employment

Although paid volunteer work involves receiving compensation, it is essential to distinguish it from regular employment. In traditional employment, individuals provide services in exchange for wages, whereas paid volunteer work involves individuals offering their skills and time in support of a cause while also receiving some form of payment.

3. Taxation of Paid Volunteer Work

In general, the taxation of paid volunteer work depends on the nature and purpose of the compensation received. If the payment is regarded as a form of reimbursement for out-of-pocket expenses incurred during volunteering activities, it may not be taxable. However, if the compensation is seen as regular income or a salary, it is likely to be subject to taxation.

4. Factors Influencing Taxability

Several aspects determine whether paid volunteer work is taxable or not. These factors include the organization’s tax-exempt status, the purpose of the compensation, the agreement between the volunteer and the organization, and the laws and regulations governing volunteer work in a particular jurisdiction.

5. Employer Identification Number (EIN) and Reporting Requirements

Nonprofit organizations and government agencies that engage volunteers and provide compensation may be required to obtain an EIN and report the payments made to the volunteers. This process ensures transparency and compliance with tax laws, allowing authorities to monitor the tax liabilities associated with paid volunteer work.

6. Volunteering Abroad and Taxation

When it comes to volunteering abroad, the tax implications can become more complex. Different countries have varying regulations regarding the taxation of volunteer income earned overseas. It is advisable for individuals considering such opportunities to seek professional advice and understand the tax laws governing international volunteer work.

7. Benefits of Taxation on Paid Volunteer Work

While the notion of taxing paid volunteer work may seem counterintuitive, it can have its advantages. Taxation helps fund government programs and initiatives aimed at improving society as a whole. By contributing their fair share, paid volunteers can continue to support the causes they care about while also ensuring the sustainability of nonprofit organizations and governmental services.

8. Seeking Professional Guidance

Given the complexities surrounding the taxation of paid volunteer work, it is prudent for individuals involved in such activities to consult with tax professionals or specialized experts. They can provide accurate information and guidance tailored to each individual’s situation, ensuring compliance with tax laws and maximizing the benefits of paid volunteer work.

In conclusion, the taxability of paid volunteer work depends on various factors such as the purpose of compensation, the organization’s tax-exempt status, and the laws governing volunteer work. Seeking professional advice and understanding the specific tax regulations in one’s jurisdiction is crucial to ensure compliance and make informed decisions about engaging in paid volunteer activities.

From a professional standpoint, it is important to address the question of whether paid volunteer work is taxable. This issue has implications for both volunteers and organizations alike, as understanding the tax implications is crucial for compliance with legal requirements and avoiding potential penalties. Below are some key points to consider:

1. Classification of paid volunteer work:

- Paid volunteer work can be classified as a form of employment, where individuals receive compensation for their services while still engaging in activities traditionally associated with volunteering.

- It is essential to distinguish between genuine volunteers, who freely offer their time and skills without receiving any form of payment, and individuals engaged in paid volunteer work, as they may be subject to different tax obligations.

2. Taxability of paid volunteer work:

- The taxability of paid volunteer work largely depends on the specific circumstances, such as the amount of compensation received and the nature of the organization.

- In general, payments made to individuals for their services, even if labeled as volunteer work, may be considered taxable income by the tax authorities.

- Volunteers engaging in paid volunteer work should consult tax experts or appropriate government agencies to determine their tax obligations and ensure compliance with tax laws.

3. Reporting requirements for organizations:

- Organizations that engage individuals in paid volunteer work may have reporting obligations, such as issuing Form W-2 or Form 1099 to document the compensation provided.

- Failure to accurately report paid volunteer work can result in penalties for organizations, as they are responsible for complying with tax regulations and providing accurate information to the tax authorities.

- Organizations should seek guidance from tax professionals or consult relevant tax regulations to understand their reporting responsibilities related to paid volunteer work.

4. Deductibility of expenses:

- Individuals engaged in paid volunteer work may be eligible to deduct certain expenses related to their activities, such as transportation costs or supplies used for volunteering.

- To claim deductions, volunteers must meet specific criteria set by tax laws, and it is crucial to keep accurate records and receipts to support these deductions.

- Consulting tax professionals or referring to tax regulations can help individuals determine which expenses are deductible and ensure compliance with applicable rules.

In conclusion, the taxability of paid volunteer work depends on various factors, and both volunteers and organizations should take the necessary steps to understand and fulfill their tax obligations. Given the potential complexities involved, seeking professional advice and referring to relevant tax regulations is highly recommended to ensure compliance and avoid potential penalties.

Thank you for taking the time to visit our blog and explore the topic of paid volunteer work and its taxability. We hope that the information provided has been insightful and has answered any questions you may have had regarding this matter. Before we conclude, let’s summarize the key points discussed throughout the article.

Firstly, it is important to understand that the term paid volunteer work itself seems contradictory. Traditional volunteering involves offering your services without any expectation of financial compensation. However, there are instances where individuals receive some form of payment or benefits while engaging in volunteer activities. In such cases, the tax implications can vary depending on the nature of the payment and the purpose of the organization.

It is crucial to recognize that not all payments received during volunteer work are taxable. The Internal Revenue Service (IRS) distinguishes between reimbursements and income. Reimbursements for certain expenses, such as travel or meals directly related to volunteering, are generally not considered taxable. On the other hand, if the payment or benefit is given in exchange for services rendered, it may be subject to taxation. It is recommended to consult the IRS guidelines or a tax professional to determine the specific tax treatment in your situation.

In conclusion, the taxability of paid volunteer work depends on several factors, including the purpose of the organization and the nature of the payment or benefit received. While some payments may be exempt from taxation as reimbursements, others may be considered taxable income. It is essential to familiarize yourself with the IRS guidelines and consult with a tax professional to ensure compliance with applicable tax laws.

We hope that this article has shed light on the topic of paid volunteer work and its tax implications. If you have any further questions or need assistance, please feel free to reach out to us. Thank you once again for visiting our blog, and we look forward to providing you with more valuable insights in the future!

Video Is Paid Volunteer Work Taxable

Here are some common questions people ask about whether paid volunteer work is taxable:

Is paid volunteer work considered taxable income?

Do I need to report paid volunteer work on my tax return?

Are there any exceptions where paid volunteer work may not be taxable?

What if I receive non-monetary compensation for my volunteer work?

Are there any deductions or credits available for paid volunteer work?

Answer: Yes, paid volunteer work is generally considered taxable income. The Internal Revenue Service (IRS) views it as compensation for services rendered, regardless of the fact that it may involve charitable or nonprofit organizations.

Answer: Yes, you must report any income received from paid volunteer work on your tax return. This income should be reported as wages on your Form 1040 or other applicable tax forms.

Answer: In certain cases, if the paid volunteer work is performed for a qualified nonprofit organization, and the earnings are below a specific threshold, it may be exempt from federal income tax. However, it is important to consult with a tax professional or refer to IRS guidelines to determine if you qualify for such an exemption.

Answer: If you receive non-monetary compensation, such as goods or services, in exchange for your volunteer work, the fair market value of those items or services may be considered taxable income. It is essential to report this value on your tax return.

Answer: While paid volunteer work itself may not provide specific deductions or credits, you may be eligible for other tax benefits related to charitable contributions or expenses incurred during your volunteer activities. These benefits can vary, so it is advisable to consult with a tax professional or refer to IRS guidelines for more information.