Table of Contents

Learn how to become a volunteer for the Income Tax Assistance Program and provide free tax help to low-income individuals and families. Discover the requirements, training opportunities, and benefits of volunteering in this rewarding program. Make a difference in your community by helping others with their tax returns.

Are you interested in making a positive impact on your community while honing your professional skills? Look no further than the Volunteer Income Tax Assistance (VITA) program! As tax season approaches, countless individuals and families struggle to navigate the complexities of filing their returns. This is where VITA steps in, offering free tax preparation services for low-income individuals, elderly taxpayers, persons with disabilities, and limited English-speaking taxpayers. By becoming a VITA volunteer, you can contribute to helping these individuals access the tax credits and refunds they are entitled to, all while gaining valuable experience in tax preparation and building connections with like-minded professionals. So, let’s dive into how you can become a part of this rewarding program and make a difference in the lives of those in need.

Are you interested in helping others and making a difference in your community? Becoming a volunteer for the Volunteer Income Tax Assistance (VITA) program might be the perfect opportunity for you. VITA is a federally-supported initiative that provides free tax preparation services to low-income individuals and families. By becoming a VITA volunteer, you can gain valuable skills, make a positive impact on people’s lives, and contribute to the overall well-being of your community. Here’s a step-by-step guide on how to become a VITA volunteer:

Step 1: Understand the VITA Program

Before diving into the volunteer application process, it’s important to familiarize yourself with the VITA program. The VITA program is administered by the IRS and offers free tax help to individuals with low-to-moderate income, elderly taxpayers, persons with disabilities, and limited English-speaking taxpayers. Volunteers in the program receive training to provide basic tax return preparation assistance, ensuring that eligible individuals receive all the tax credits and deductions they are entitled to.

Step 2: Assess Your Skills and Commitment

Before committing to becoming a VITA volunteer, assess your skills and availability. While previous tax experience is not required, having a basic understanding of tax concepts can be helpful. You should also consider the time commitment involved in volunteering. During the tax season, which typically runs from January to April, volunteers are expected to dedicate a certain number of hours each week to assist taxpayers.

Step 3: Find a Local VITA Site

To become a VITA volunteer, you’ll need to find a local VITA site in your community. The IRS provides a search tool on their website where you can enter your zip code and find nearby VITA locations. Once you have identified a site, reach out to them to express your interest in volunteering and inquire about their specific requirements and application process.

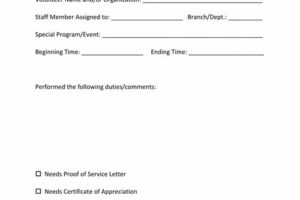

Step 4: Complete the Volunteer Application

Most VITA sites will require you to complete a volunteer application form. This form collects information about your background, skills, and availability. It may also include questions about your willingness to undergo a background check, as volunteers handle sensitive financial information. Take your time to complete the application accurately and truthfully, as this information will help the VITA site match you with an appropriate role.

Step 5: Attend Training Sessions

Once your application is accepted, you will be required to attend training sessions provided by the VITA program. These training sessions are designed to equip volunteers with the necessary tax law knowledge and software skills to assist taxpayers effectively. The training may be conducted in-person or online, depending on the VITA site’s preferences.

Step 6: Obtain Certification

After completing the training sessions, you will be required to pass a certification test to ensure that you have grasped the tax preparation concepts and can accurately prepare tax returns. The certification test is typically open book and can be taken online or in-person. Some VITA sites may also require volunteers to pass additional state-specific certification tests.

Step 7: Choose Your Role

As a VITA volunteer, you can choose from various roles based on your skills and comfort level. Some volunteers prefer to provide one-on-one tax preparation assistance, while others may assist with administrative tasks or serve as interpreters for limited English-speaking taxpayers. Discuss your preferences with the VITA site coordinator, and they will assign you a suitable role.

Step 8: Start Volunteering

Once you have completed your training and obtained certification, it’s time to start volunteering. Collaborate with the VITA site coordinator to determine your schedule and commit to the agreed-upon hours. Remember to maintain professionalism and confidentiality while assisting taxpayers, as their financial information should always be treated with the utmost sensitivity.

Step 9: Continuously Learn and Grow

The world of tax preparation is constantly evolving, with new tax laws and regulations introduced each year. As a VITA volunteer, it’s essential to stay updated with these changes to ensure accurate tax return preparation. Take advantage of ongoing training opportunities and resources provided by the VITA program to enhance your skills and knowledge.

Step 10: Celebrate Your Impact

By dedicating your time as a VITA volunteer, you are making a significant impact on the lives of individuals and families in need. Celebrate the positive change you are creating in your community and encourage others to get involved in this rewarding endeavor. The satisfaction of helping others navigate the complex world of taxes is immeasurable.

Becoming a VITA volunteer is an excellent opportunity to give back to your community, develop valuable skills, and make a difference in the lives of those who need it most. Follow these steps, embark on your volunteering journey, and become an integral part of the Volunteer Income Tax Assistance program.

Introduction

Becoming a volunteer for the Volunteer Income Tax Assistance Program (VITA) is a great opportunity to contribute to your community while gaining valuable experience in the field of tax preparation. By offering free tax help to people who need it, VITA volunteers play a crucial role in ensuring that individuals and families receive the tax credits and refunds they are entitled to. If you are interested in becoming a VITA volunteer, follow the steps outlined below to get started.

1. Research the VITA Program:

Before embarking on your journey to become a VITA volunteer, it is essential to familiarize yourself with the program’s mission, objectives, and target audience. Perform thorough research to gain an understanding of how the program operates and the services it provides to individuals in need of tax assistance. This will help you align your interests and goals with those of the VITA program and prepare you for the tasks ahead.

2. Meet the Eligibility Requirements:

Check if you meet the eligibility requirements set by the VITA program. These requirements may include a minimum age, background checks, and fluency in the English language. Understanding the eligibility criteria will help determine if you are qualified to become a VITA volunteer. It is important to ensure that you meet all the necessary requirements to avoid any issues during the application process.

3. Complete the Volunteer Training:

VITA volunteers are required to undergo training to enhance their tax preparation skills and familiarize themselves with the program’s policies and guidelines. Reach out to your local VITA program coordinator to inquire about available training opportunities and schedule your training sessions accordingly. The training will equip you with the knowledge and skills needed to provide accurate and reliable tax assistance to those in need.

4. Consider Obtaining a Tax Preparer Certification:

While it is not mandatory, obtaining a tax preparer certification can significantly boost your credibility as a VITA volunteer. Look for tax preparer certification courses offered within your area or online, and pursue the certification to demonstrate your proficiency in tax preparation. This certification will not only enhance your skills but also increase your value as a volunteer, allowing you to provide more comprehensive assistance to individuals seeking help.

5. Find a Local VITA Site:

Contact your local VITA program coordinator or visit the Internal Revenue Service (IRS) website to locate nearby VITA sites where you can provide free tax assistance to eligible individuals. Coordinate with the site coordinator to determine the best time and duration for your volunteer services. It is important to find a site that is convenient for you and aligns with your availability to ensure a smooth volunteering experience.

6. Sign Up as a Volunteer:

Once you have identified a suitable VITA site, reach out to the site coordinator to express your interest in becoming a volunteer. They will provide you with the necessary paperwork and guide you through the registration process, ensuring that you are fully equipped for your role as a VITA volunteer. Completing the registration process promptly will allow you to start making a difference in people’s lives as soon as possible.

7. Attend Orientation Sessions:

In addition to training, VITA programs often hold orientation sessions to inform volunteers about program updates, changes in tax laws, and best practices. Attending these sessions will help you stay informed and continually improve your skills as a VITA volunteer. The orientation sessions provide valuable insights and ensure that you are up to date with any changes that may affect your tax assistance services.

8. Dedicate Your Time and Effort:

As a VITA volunteer, it is essential to commit yourself to the program’s mission and allocate sufficient time to fulfill your responsibilities. Show up prepared and ready to provide accurate and reliable tax assistance to individuals in your community who rely on the VITA program for support. Dedicate your time and effort to make a positive impact on the lives of others and ensure that they receive the tax credits and refunds they deserve.In conclusion, becoming a VITA volunteer offers a fulfilling experience that enables you to make a positive impact on the lives of others while expanding your knowledge in tax preparation. Embrace this opportunity with enthusiasm and dedication while following the program’s guidelines and serving as a trusted resource for those in need. By becoming a VITA volunteer, you have the power to help individuals and families in your community thrive financially and achieve their goals.

A Volunteer Income Tax Assistance (VITA) Program is an excellent opportunity for individuals to give back to their community and make a real difference in the lives of others. By volunteering your time and expertise, you can help low-income individuals and families navigate the complexities of the tax system and ensure they receive the maximum benefits and refunds they are entitled to.

Here are some key points to consider if you are interested in becoming a volunteer for a VITA Program:

- Professionalism: As a VITA volunteer, it is important to maintain a professional voice and tone when interacting with clients. This means being courteous, respectful, and non-judgmental at all times. Treat every client with empathy and understanding, regardless of their financial situation or background.

- Knowledge and Training: Before becoming a VITA volunteer, it is essential to acquire the necessary knowledge and training to provide accurate and reliable tax assistance. Many VITA Programs offer comprehensive training sessions that cover topics such as tax law, software usage, and client interaction. Take advantage of these training opportunities to enhance your skills and ensure you are well-prepared to assist clients effectively.

- Confidentiality: Maintaining client confidentiality is of utmost importance in a VITA Program. Volunteers must adhere to strict privacy policies and ensure that all client information remains confidential. Respect and protect the privacy rights of every individual you assist.

- Attention to Detail: When preparing tax returns, attention to detail is crucial. Carefully review all documentation provided by clients, ask clarifying questions when necessary, and double-check calculations to minimize errors. Accuracy is key to ensuring clients receive the maximum benefits and avoid any potential issues with the IRS.

- Communication Skills: Effective communication is vital when working with clients who may have limited knowledge of tax matters. Use clear and concise language, avoiding jargon or technical terms that may confuse or overwhelm individuals. Listen attentively to clients’ questions and concerns, and provide explanations in a patient and understandable manner.

- Continued Learning: The tax landscape is constantly evolving, with new laws and regulations being introduced regularly. As a VITA volunteer, it is essential to stay updated on these changes to provide accurate assistance. Engage in ongoing learning opportunities, attend workshops, and stay informed through reliable sources to maintain your expertise.

- Embrace Diversity: The clients you encounter as a VITA volunteer come from diverse backgrounds and cultures. Embrace this diversity and approach every interaction with cultural sensitivity and respect. Be mindful of potential language barriers and strive to create an inclusive environment where everyone feels welcome and understood.

Becoming a volunteer for a VITA Program is a rewarding experience that allows you to make a meaningful impact on the lives of others. By following these guidelines and approaching your role with professionalism and compassion, you can contribute to the success of the program and help individuals and families achieve financial stability.

Thank you for taking the time to visit our blog and learn about how to become a Volunteer Income Tax Assistance (VITA) program volunteer. We hope that this article has provided you with valuable information and insights into the process of joining this rewarding volunteer opportunity. Becoming a VITA volunteer not only allows you to give back to your community but also offers a chance to enhance your skills and make a positive impact on the lives of others.

If you are considering becoming a VITA volunteer, we strongly encourage you to take the next steps towards joining this incredible program. The first step is to familiarize yourself with the requirements and responsibilities of a VITA volunteer. As mentioned in the article, VITA volunteers must complete training to gain the necessary knowledge and skills to assist individuals with their tax preparation. This training is provided by the IRS and covers topics such as tax law, ethics, and customer service. By successfully completing the training, you will be equipped with the tools needed to effectively support taxpayers in navigating the complex world of taxes.

Once you have completed the training, you can then proceed to apply to become a VITA volunteer. The process typically involves filling out an application form and undergoing a background check. It is important to note that VITA programs are run by various organizations, such as nonprofits, community centers, and educational institutions, so the application process may vary slightly depending on the organization you choose to volunteer with. However, rest assured that all VITA programs follow the guidelines set by the IRS to ensure consistency and quality in the services provided.

In conclusion, becoming a VITA volunteer is an excellent way to contribute to your community while gaining valuable skills and experience. We encourage you to take the leap and embark on this fulfilling journey. By dedicating your time and effort to helping others with their tax preparation, you will not only make a difference in their lives but also find personal fulfillment and growth. Remember, every small act of kindness counts, and by becoming a VITA volunteer, you have the power to make a lasting impact. Thank you again for visiting our blog, and we wish you the best of luck on your journey to becoming a VITA volunteer!

Video How To Become A Volunteer Income Tax Assistance Program

People also ask about How To Become a Volunteer Income Tax Assistance (VITA) Program:

What is the Volunteer Income Tax Assistance (VITA) program?

The Volunteer Income Tax Assistance (VITA) program is an initiative by the Internal Revenue Service (IRS) that provides free tax preparation assistance to individuals and families with low-to-moderate incomes, persons with disabilities, elderly taxpayers, and limited English-speaking taxpayers.

How can I become a VITA volunteer?

To become a VITA volunteer, follow these steps:

- Contact your local IRS office or visit the IRS website to find the nearest VITA program.

- Reach out to the VITA program coordinator and express your interest in becoming a volunteer.

- Complete the required training provided by the IRS to gain knowledge on tax laws and filing procedures.

- Pass the certification exam to demonstrate your understanding of tax preparation.

- Commit to volunteering for a specific number of hours during the tax filing season.

What are the benefits of becoming a VITA volunteer?

Becoming a VITA volunteer offers several benefits:

- You can make a positive impact on your community by helping individuals and families with their tax filings.

- You will gain valuable skills and knowledge in tax preparation, which can be beneficial for personal finance management.

- VITA volunteers often receive recognition and appreciation from the IRS and the community for their service.

- Volunteering for the VITA program can also provide networking opportunities and enhance your resume.

What qualifications do I need to become a VITA volunteer?

To become a VITA volunteer, you generally need to:

- Be fluent in English (additional language skills may be preferred in certain communities).

- Have good communication and interpersonal skills to assist taxpayers effectively.

- Complete the required training and pass the certification exam.

- Commit to volunteering for the specified hours during the tax filing season.

- Adhere to the ethical guidelines and confidentiality rules set by the IRS.

Can I claim any tax benefits for volunteering with VITA?

No, volunteering with VITA does not provide any direct tax benefits or deductions. However, the experience and skills gained from volunteering can indirectly benefit your personal financial management.

Remember to reach out to your local IRS office or visit the IRS website for more specific information on how to become a VITA volunteer in your area.