Table of Contents

Wondering if you can claim volunteer work on your taxes? Find out if your charitable contributions are eligible for tax deductions and learn about the requirements and limitations involved in claiming volunteer expenses on your tax return.

Are you someone who selflessly dedicates their time and energy to volunteer work? If so, you may be wondering whether you can reap any financial benefits from your noble efforts. The good news is that the answer is yes – you may be able to claim volunteer work on your taxes. By understanding the intricacies of tax deductions for volunteer work, you can potentially maximize your financial gains while still making a positive impact on your community. In this article, we will explore the various factors involved in claiming volunteer work on your taxes and provide you with valuable insights to navigate the process smoothly.

Introduction

Volunteering is a selfless act that allows individuals to give back to their communities by donating their time, skills, and expertise. Many people wonder if they can claim volunteer work on their taxes, as it would provide an additional incentive to contribute. In this article, we will explore the possibility of claiming volunteer work on your taxes and the conditions under which it may be possible.

Understanding Volunteering

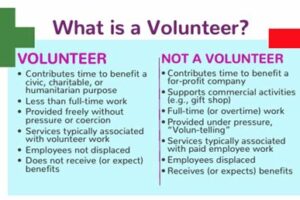

Volunteering typically involves offering services or performing tasks for the benefit of others without receiving any financial compensation. It is essential to differentiate between volunteering and providing services as an independent contractor or freelancer where payment is received. The IRS defines volunteering as activities performed for qualified organizations, such as charities, religious groups, and governmental agencies, without any expectation of compensation.

Deductible Expenses

While you cannot claim the value of your time spent volunteering as a tax deduction, there are certain expenses related to volunteer work that may be deductible. These expenses must meet specific criteria set by the IRS, and you must keep accurate records to substantiate your claims.

Travel Expenses

If you travel for volunteer work, whether it’s within your local community or to another location, you may be eligible to deduct your transportation costs. This includes mileage, parking fees, tolls, and public transportation expenses incurred while performing volunteer services. However, you cannot deduct expenses if you were reimbursed or if there was a significant element of personal pleasure, recreation, or vacation during the trip.

Uniforms and Supplies

If you are required to wear a uniform or purchase supplies for your volunteer work, you may be able to deduct these expenses. The uniform must not be suitable for everyday wear, and it should clearly identify you as a volunteer for the organization. Additionally, any supplies or materials you purchase exclusively for volunteering purposes may also be eligible for deduction.

Out-of-Pocket Expenses

Out-of-pocket expenses incurred while performing volunteer work may also be deductible. These expenses could include costs related to phone calls, postage, and other necessary expenditures directly associated with your volunteer services. However, it is crucial to keep detailed records and receipts to substantiate these expenses when filing your taxes.

Non-Deductible Expenses

While there are certain deductible expenses related to volunteer work, it is important to note that not all expenses qualify. The following expenses are generally considered non-deductible:

Value of Your Time

The IRS does not allow you to claim the value of your time spent volunteering as a tax deduction. While your efforts may be invaluable to the organization you are helping, the IRS only allows deductions for actual out-of-pocket expenses.

Personal Expenses

Expenses that are considered personal or unrelated to your volunteer work cannot be claimed as deductions. For example, if you decide to take a vacation while on a volunteering trip, the expenses related to your personal activities would not be deductible.

Record-Keeping and Documentation

Proper record-keeping is essential when it comes to claiming deductions for volunteer work. To ensure you have the necessary documentation, consider the following:

Keep Track of Your Expenses

Maintain a detailed log of your expenses related to volunteer work. This includes mileage, parking fees, uniform costs, supplies purchased, and any other out-of-pocket expenses. Having accurate records will make claiming deductions easier and help in case of an audit.

Obtain Written Acknowledgments

For expenses exceeding $250, it is necessary to obtain written acknowledgments from the organization you volunteered for. These acknowledgments should provide details of the services rendered, the dates, and a statement confirming whether or not you received any goods or services in return.

Consult with a Tax Professional

When it comes to tax deductions and claiming volunteer work, it is always advisable to consult with a tax professional or accountant. They can provide guidance based on your specific situation and ensure you are taking advantage of any potential deductions while staying within the IRS guidelines.

Conclusion

While you cannot claim the value of your time spent volunteering, certain expenses related to your volunteer work may be deductible. Travel expenses, uniforms and supplies, as well as out-of-pocket expenses, could potentially qualify for deduction. However, it is crucial to keep accurate records and consult with a tax professional to navigate the complexities of claiming volunteer work on your taxes. Remember, the true reward of volunteering lies in the positive impact you make on others, rather than the tax benefits it may provide.

Introduction to Claiming Volunteer Work on Taxes

When it comes to filing your taxes, you may wonder whether you can claim volunteer work as a deduction. While volunteer efforts are typically driven by a desire to make a difference rather than financial gain, there are instances where you may be eligible to claim certain expenses related to volunteering on your tax return.

Understanding IRS Guidelines for Deducting Volunteer Work

Before claiming any deductions for volunteer work, it is crucial to familiarize yourself with the guidelines provided by the Internal Revenue Service (IRS). Generally, the IRS allows deductions for unreimbursed expenses incurred while performing services for a qualified nonprofit organization. However, it is important to understand the specific requirements and limitations outlined by the IRS to ensure compliance.

Qualified Organizations for Tax-Deductible Volunteer Work

Not all volunteer work performed for any organization is tax-deductible. To claim volunteer work as a deduction, the organization you are volunteering for must meet the criteria outlined by the IRS. Generally, this includes qualifying charitable, religious, educational, or government entities. It is advisable to verify the organization’s eligibility before claiming any deductions on your tax return.

Eligible Volunteer Expenses for Deduction

While you may not be able to deduct the value of your time and services, there are certain eligible expenses that can be claimed as deductions. These expenses may include transportation costs, out-of-pocket expenses for supplies or materials directly related to your volunteer work, and other expenses incurred in the performance of volunteer services. It is important to keep accurate records and receipts to support these deductions.

Mileage Deductions for Volunteer Work

One common deduction for volunteer work is mileage. The IRS allows you to deduct the miles driven while volunteering at a qualified organization. To qualify, the mileage must be directly related to your volunteer services and not include any personal or commuting mileage. Keeping a detailed record of your mileage is essential to substantiate your deduction.

Documentation Requirements for Claiming Volunteer Work Tax Deductions

Proper documentation is crucial when claiming volunteer work on your tax return. It is recommended to maintain records such as receipts, canceled checks, volunteer organization acknowledgments, mileage logs, and any other supporting documentation that validates your expenses and the services provided. Failing to provide adequate documentation may result in the disallowance of your deductions.

Limits and Restrictions on Deducting Volunteer Work

While deductions for volunteer work can reduce your overall tax liability, it’s important to understand that there are certain limits and restrictions. These limitations may include provisions regarding the percentage of your adjusted gross income (AGI) that can be claimed as deductions, as well as any benefits or reimbursements received from the volunteering organization. Familiarize yourself with the IRS guidelines to ensure you comply with the applicable limitations.

Seeking Professional Tax Advice for Volunteer Work Deductions

As the tax code is complex and subject to change, seeking advice from a qualified tax professional is advisable when considering deductions for volunteer work. An experienced tax professional can provide personalized guidance and help ensure you comply with all IRS requirements and regulations, increasing your chances of successfully claiming volunteer work on your taxes while minimizing any potential audit risks.

As a professional tax advisor, it is important to provide accurate and reliable information regarding the claimability of volunteer work on taxes. Below are key points and considerations regarding this topic:

Volunteer work, while commendable and essential for many organizations, cannot be claimed as a deduction on personal income taxes. The Internal Revenue Service (IRS) strictly states that the value of your time and services cannot be considered as a charitable contribution for tax purposes.

However, it is important to note that certain expenses incurred during volunteering activities may be eligible for deductions. These expenses must meet specific criteria set by the IRS to qualify. Examples of such eligible expenses include transportation costs directly related to the volunteer work, unreimbursed out-of-pocket expenses for supplies or materials used in volunteering, and uniform costs required by the organization.

To claim these eligible expenses, you will need to itemize your deductions using Schedule A of your tax return. It is important to keep detailed records of your expenses, including receipts and documentation, to substantiate your claims in case of an audit or review.

When claiming eligible expenses, it is crucial to ensure that they are directly related to the volunteer work performed for a qualified organization. Volunteer work done for personal reasons or for-profit entities does not qualify for deductions.

If you do incur expenses while volunteering, it is important to remember that the potential tax benefit should not be the sole motivation for volunteering. The primary purpose of volunteering should be to support charitable causes and make a positive impact on the community.

It is highly recommended to consult with a tax professional or utilize tax software to accurately determine your eligibility for deductions related to volunteer work. They can guide you through the specific rules and regulations, ensuring compliance with the IRS guidelines.

In summary, while volunteer work itself cannot be claimed as a deduction on personal income taxes, eligible expenses incurred during volunteering activities may qualify for deductions. It is essential to keep thorough records and consult with a tax professional to ensure compliance with IRS guidelines and maximize any eligible deductions.

Thank you for taking the time to read our blog post on the topic of claiming volunteer work on your taxes. We hope that the information provided has been helpful and informative, allowing you to make an informed decision regarding your tax situation. While we are not tax professionals, we have done extensive research to provide you with the most accurate and up-to-date information available.

It is important to note that the rules and regulations surrounding volunteer work and tax deductions can vary depending on your jurisdiction. Therefore, it is always best to consult with a qualified tax professional or accountant who can provide personalized advice based on your specific circumstances. They will be able to guide you through the process and ensure that you are maximizing any potential tax benefits.

Additionally, it is crucial to keep detailed records of your volunteer work, including the dates, hours worked, and the organization with which you volunteered. This documentation will be essential when filing your taxes and substantiating any deductions or credits you may be eligible for. Remember to obtain written acknowledgment from the organization you volunteered with, as this may be required by the tax authorities as well.

In conclusion, while it may be possible to claim volunteer work on your taxes, it is important to proceed with caution and seek professional advice. The rules and regulations surrounding this area can be complex, and making mistakes could lead to penalties or other legal consequences. We encourage you to reach out to a tax professional who can assist you in navigating the intricacies of claiming volunteer work on your taxes and help you make the most of any potential benefits available to you.

Thank you once again for visiting our blog, and we hope that this article has provided you with valuable insights. If you have any further questions or topics you would like us to cover, please do not hesitate to reach out. We are here to help!

Video Can I Claim Volunteer Work On My Taxes

1. Can I claim volunteer work on my taxes?

Volunteer work itself cannot be directly claimed as a tax deduction since it does not involve any out-of-pocket expenses or financial contributions. However, there are certain circumstances in which you may be eligible to claim certain expenses related to your volunteer work.

2. What expenses related to volunteer work can I claim on my taxes?

If you incurred any out-of-pocket expenses while performing volunteer work for a qualified organization, you may be able to claim these expenses as deductions on your taxes. These expenses can include items such as travel expenses (mileage, parking fees, and tolls), supplies and materials used for volunteering, and even certain uniforms required by the organization.

3. Are there any restrictions on claiming volunteer-related expenses?

Yes, there are some restrictions when it comes to claiming volunteer-related expenses. First, the organization you volunteer for must be a qualified charitable organization recognized by the IRS. Additionally, you need to keep detailed records of all your expenses, including receipts and documentation, to support your claims.

4. How do I claim volunteer-related expenses on my taxes?

To claim volunteer-related expenses, you will need to itemize your deductions using Schedule A of your tax return. Within this schedule, you can report your volunteer-related expenses under the appropriate category, such as Charitable Contributions. It is recommended to consult with a tax professional or use tax software to ensure you are accurately reporting and claiming these expenses.

5. Is there a limit to the amount I can claim for volunteer-related expenses?

Yes, there may be limitations on the amount you can claim for volunteer-related expenses. Generally, the total of your itemized deductions, including volunteer-related expenses, must exceed the standard deduction for your filing status in order to be beneficial. Keep in mind that specific limitations and regulations can vary, so it’s advisable to consult with a tax professional for personalized guidance.

6. Can I claim the value of my time spent volunteering on my taxes?

No, the value of your time spent volunteering is not deductible on your taxes. The IRS does not allow deductions for the value of services rendered, even if they are performed for charitable purposes. Deductions are typically limited to actual out-of-pocket expenses incurred while volunteering.

Remember, it is always recommended to consult with a tax professional or utilize tax software to ensure proper reporting and claiming of volunteer-related expenses on your taxes.