Table of Contents

Find out how to fill out a tax form for volunteer work with our comprehensive guide. Learn about the necessary forms, deductions, and credits that can help you maximize your tax benefits as a volunteer. Ensure you are fulfilling your tax obligations while making the most of your altruistic efforts.

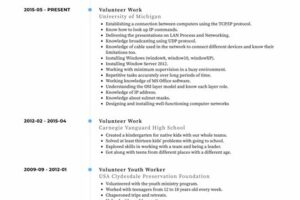

Volunteering is not only a noble act that benefits society, but it also provides individuals with the opportunity to develop new skills and gain valuable experience. However, many volunteers may be unaware of the tax implications that come with their generous efforts. It is crucial for volunteers to understand the importance of reporting their volunteer work on tax forms, as it can potentially lead to significant financial benefits. By properly documenting their volunteer activities, individuals can not only help themselves but also contribute to building a stronger community. Therefore, it is essential to explore the tax form for volunteer work and understand how it can make a difference in both personal and public finances.

Introduction

Volunteering is a noble act that not only benefits society but also gives individuals a sense of purpose and fulfillment. If you have dedicated your time and skills to volunteer work, it’s important to understand the tax implications and the forms associated with it. In this article, we will explore the tax form for volunteer work and provide a comprehensive guide on how to navigate this aspect of your volunteering experience.

Understanding Volunteer Work

Before delving into the tax form requirements, let’s first clarify what qualifies as volunteer work. Volunteer work involves providing services to an organization or community without receiving financial compensation. This can include activities such as tutoring, mentoring, assisting at local events, working in food banks, or participating in charitable projects.

Volunteer Work and Taxes

While the time and effort you dedicate to volunteer work may not bring about a paycheck, it is still important to consider the tax implications. The good news is that in most cases, volunteer work does not generate taxable income. However, there are certain situations where you may need to report your volunteer activities to the IRS.

When to Report Volunteer Work

In general, you do not need to report volunteer work if you are not receiving any form of compensation, reimbursement, or benefits. However, there are a few instances where you may need to report the value of your volunteer services:

Form 1099-MISC

If you receive any form of compensation or benefits exceeding $600 in a tax year, the organization you volunteered for may be required to issue you a Form 1099-MISC. This form reports miscellaneous income and is typically used for independent contractors or self-employed individuals. When receiving this form, make sure to report the income accurately on your tax return.

Form W-2

In some cases, organizations might mistakenly treat volunteers as employees and issue them a Form W-2 instead of a 1099-MISC. If you receive a Form W-2, reach out to the organization and explain that you were a volunteer and not an employee. They should correct the error and issue the appropriate form.

Record-Keeping for Volunteer Work

Even if you do not need to report your volunteer work on tax forms, it is crucial to keep detailed records of your activities. These records can include the organization’s name, dates of service, a description of the services provided, and any expenses incurred while volunteering. Maintaining accurate records will make it easier to substantiate your volunteer work in case of an audit or if you need to provide documentation in the future.

Deducting Expenses Related to Volunteer Work

While the time you spend volunteering is not tax-deductible, some expenses associated with your volunteer work may be eligible for deductions. However, these deductions are subject to specific requirements set by the IRS. The expenses must be:

1. Unreimbursed

You can only deduct expenses that were not reimbursed by the organization you volunteered for. If you were reimbursed for any expenses, you cannot claim them as deductions.

2. Directly Related to the Volunteer Work

The expenses must be directly connected to your volunteer work. This can include transportation costs, supplies, or other expenses necessary for carrying out your volunteering duties.

3. Substantiated

You must have proper documentation to substantiate the expenses you plan to deduct. This can include receipts, invoices, or mileage logs, depending on the nature of the expense. Keeping accurate records is essential in this regard.

Form 8283 for Non-Cash Contributions

If you make non-cash contributions to an organization as part of your volunteer work, such as donating goods or services, you may need to file Form 8283. This form is used to report non-cash charitable contributions exceeding $500 in value. It requires a detailed description of the contributed items and their fair market value.

Consulting a Tax Professional

Navigating the tax implications of volunteer work can sometimes be complex, especially if you are unsure about which forms to use or how to handle deductions. In such cases, it is highly recommended to consult with a tax professional who specializes in charitable contributions and volunteering. They can provide personalized guidance based on your specific situation and ensure that you are fulfilling all tax obligations correctly.

Conclusion

Volunteering is a selfless act that brings positive change to communities and individuals in need. While most volunteer work does not generate taxable income, it is important to understand the tax implications and reporting requirements. By familiarizing yourself with the relevant tax forms and keeping accurate records, you can ensure a smooth and compliant experience while continuing to make a difference through your volunteer efforts.

I. Introduction

As a volunteer, it is crucial to have a clear understanding of the tax implications that may arise from any benefits or reimbursements received. The purpose of this guide is to equip you with comprehensive knowledge about tax forms related to volunteer work, enabling you to navigate the intricacies of tax filing.

II. Form W-2: Reporting Volunteer Compensation

If you receive compensation for your volunteer work, the organization may issue you a Form W-2. This form serves to report your earnings and any applicable taxes withheld by the organization. It is essential to include this form when filing your tax return to ensure accurate reporting of your income.

III. Form 1099-MISC: Reporting Non-Employee Income

In certain cases, volunteers may receive non-employee income, such as stipends or honorariums. If the total amount received surpasses $600 for the tax year, the organization may issue a Form 1099-MISC to report this income. It is crucial to report this income on your tax return in accordance with the provided form.

IV. Form 8283: Reporting Charitable Contributions

If you make substantial donations to qualifying organizations while volunteering, you may be eligible to claim a tax deduction. Form 8283 should be utilized to report these contributions, providing detailed information about the donated items and their fair market value.

V. Form 1040: Reporting Volunteer Expenses

Although volunteers generally cannot deduct the value of their time and services, they may be eligible to deduct related expenses if they meet specific criteria. Form 1040 allows volunteers to itemize these expenses, such as travel costs or supplies, potentially reducing their taxable income.

VI. Form 8853: Reporting Foreign Volunteer Work

If you engage in volunteer work outside of the United States, it is necessary to use Form 8853 to report your foreign income and any associated exclusions or deductions. This form ensures compliance with international taxation requirements and prevents potential dual-taxation issues.

VII. Form 4506-T: Requesting Volunteer Work Income Verification

In some instances, lenders or other entities may require verification of your volunteer work income. Form 4506-T allows you to request a transcript of your tax return, providing third parties with documentation of your income and tax filing status.

VIII. Form 8962: Reporting Health Insurance Coverage

If you are a volunteer eligible for premium tax credits, it may be necessary to file Form 8962 to reconcile these credits and report your health insurance coverage for the year. This form ensures an accurate determination of any premium tax credits you may be eligible for.

Please note that while this guide provides an overview of common tax forms for volunteer work, it is always advisable to consult with a tax professional or utilize tax software to ensure compliance with the latest tax laws and regulations.

In my professional opinion, the tax form for volunteer work serves as a crucial tool for both volunteers and organizations. It is essential to understand the significance of this form in order to ensure compliance with tax regulations and maximize the benefits associated with volunteer work.

Here are some key points to consider:

- Recognition of Volunteer Efforts: The tax form for volunteer work allows individuals to officially document their contributions and efforts. By providing a clear record of the volunteer work performed, this form helps recognize and validate the valuable contributions made by volunteers to various organizations and causes.

- Tax Deductions: For volunteers who itemize their deductions, the tax form for volunteer work enables them to claim certain expenses related to their volunteer activities. This may include travel expenses, supplies purchased for volunteering purposes, or other out-of-pocket costs incurred during the volunteer work. Such deductions can help reduce the overall tax liability for volunteers, encouraging more individuals to engage in volunteer work.

- Organizational Compliance: From an organizational standpoint, having volunteers complete tax forms is essential for ensuring compliance with tax laws and regulations. By maintaining accurate records of the volunteer work performed, organizations can demonstrate transparency and accountability to tax authorities, donors, and other stakeholders.

- Transparency in Fund Utilization: By documenting volunteer work through tax forms, organizations can provide a transparent account of how donated funds are utilized. This helps build trust and confidence among donors, as they can see the tangible impact of their contributions and ensures that funds are allocated appropriately.

- Volunteer Recruitment and Retention: The availability of tax forms for volunteer work can serve as an incentive for individuals to engage in volunteer activities. By knowing that their efforts are recognized and potentially eligible for tax deductions, volunteers may be more inclined to dedicate their time and skills to support various causes. Moreover, the existence of tax forms can contribute to volunteer retention rates, as it reinforces the acknowledgment and appreciation of their work.

In conclusion, the tax form for volunteer work plays a crucial role in recognizing volunteer efforts, facilitating tax deductions, ensuring organizational compliance, promoting transparency, and enhancing volunteer recruitment and retention. It is imperative for both volunteers and organizations to understand and effectively utilize this form to maximize the benefits associated with volunteer work.

Thank you for visiting our blog today to learn more about the tax form for volunteer work. We hope that this article has provided you with valuable insights and clarification on this important topic. As you continue your journey as a volunteer, it is essential to understand the tax implications of your work and ensure compliance with the relevant regulations.

Firstly, it is crucial to remember that as a volunteer, you generally will not receive monetary compensation for your services. However, this does not mean that your work goes unrecognized or unappreciated. On the contrary, volunteering is a vital aspect of any community, and your dedication and contributions are highly valued. While you may not receive payment, there are still important considerations when it comes to taxes.

When it comes to tax forms for volunteer work, the most commonly used document is the Form 1099-MISC. This form is typically used to report income earned by independent contractors, but it can also be used to report certain types of volunteer work. If you receive more than $600 in non-cash benefits from an organization as a volunteer, they may issue you a Form 1099-MISC to report this value as miscellaneous income. It is important to note that this form is not applicable to all types of volunteer work, and you should consult with a tax professional or the IRS for specific guidance based on your circumstances.

In conclusion, as a volunteer, it is important to be aware of the tax implications of your work. While most volunteers do not need to worry about filing tax forms, it is still important to keep records of any non-cash benefits received from organizations. By understanding the potential tax implications and seeking guidance when necessary, you can ensure compliance with the relevant regulations and continue making a positive impact through your volunteer efforts.

We hope that this article has provided you with valuable information and answered any questions you may have had regarding the tax form for volunteer work. Thank you once again for visiting our blog, and we encourage you to explore our other articles for further insights into various topics related to volunteering and community engagement.

.

1. Is there a specific tax form for reporting volunteer work?

Answer: No, there is no specific tax form dedicated solely to reporting volunteer work. However, volunteers may still need to report certain aspects of their volunteer activities on their tax return.

2. Do I have to pay taxes on the value of the services I provide as a volunteer?

Answer: Generally, no. The value of your services as a volunteer is not considered taxable income. However, if you receive any benefits or perks in exchange for your volunteer work, such as free lodging or meals, the value of those benefits may need to be reported as taxable income.

3. Can I deduct any expenses related to my volunteer work?

Answer: Yes, certain unreimbursed expenses directly related to your volunteer work may be deductible. This includes expenses like travel costs, supplies, and uniforms. However, it’s important to keep detailed records and only deduct eligible expenses.

4. How do I report my volunteer work on my tax return?

Answer: If you are not receiving any taxable income from your volunteer work and have no deductible expenses, you generally do not need to report it on your tax return. However, if you have received benefits or have deductible expenses, you may need to fill out certain sections or forms, such as Schedule A (Itemized Deductions) or Form 8283 (Noncash Charitable Contributions).

5. Are there any specific tax credits or deductions available for volunteers?

Answer: While there are no specific tax credits or deductions exclusively for volunteers, if you make monetary contributions to the organization you volunteer for, you may be able to claim those contributions as charitable deductions. Additionally, some expenses related to volunteering for a qualified organization may be deductible.

6. Do I need to keep any records of my volunteer work?

Answer: Yes, it is important to keep detailed records of your volunteer work, especially if you plan to deduct any expenses or report benefits received. Make sure to document the organization’s name, dates and hours volunteered, duties performed, and any expenses incurred. Having accurate records will help ensure proper reporting on your tax return.