Table of Contents

Find out if you can deduct mileage for volunteer work. Learn about the requirements and limitations for claiming deductions on your tax return.

Are you someone who dedicates their time and efforts to volunteer work? If so, you might be wondering whether you can reap any financial benefits from your selfless acts of kindness. Well, the good news is that there might be a way for you to deduct mileage expenses related to your volunteer work. While it may sound too good to be true, the Internal Revenue Service (IRS) does provide certain provisions for individuals who offer their services without expecting any monetary compensation. So, if you’re curious about how you can potentially save on your taxes while doing good in your community, keep reading to find out more.

Introduction

Volunteering is a noble act that not only benefits the community but also provides personal satisfaction and growth. However, it’s natural to wonder if there are any tax benefits associated with volunteering. One common question that often arises is, Can I deduct mileage for volunteer work? In this article, we will explore the possibility of deducting mileage expenses incurred during volunteer activities and shed light on the specific requirements and limitations.

Understanding Volunteer Work

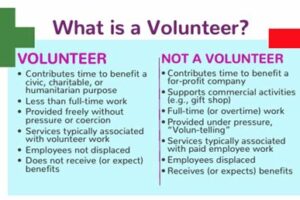

Before delving into the tax implications, it’s crucial to establish what constitutes volunteer work. Generally, volunteer work refers to services provided to a qualified organization without expecting any compensation or personal gain. This could involve helping out at a nonprofit, charitable events, or even dedicating time to religious or governmental organizations.

The Tax Deduction for Mileage

When it comes to deducting mileage for volunteer work, the Internal Revenue Service (IRS) allows taxpayers to claim a deduction for certain unreimbursed expenses. This includes mileage driven in connection with volunteer services. However, it’s important to understand the specific criteria that need to be met in order to qualify for this deduction.

Qualifying Organizations

It’s crucial to note that not all volunteer work qualifies for mileage deductions. The IRS specifies that the organization you are volunteering for must be a qualified organization. These include religious, charitable, educational, or other nonprofit organizations that meet the criteria set by the IRS. It’s advisable to verify the status of the organization before claiming any deductions.

The Standard Mileage Rate

When calculating your mileage deduction, the IRS provides a standard mileage rate that can be used. For the tax year 2021, this rate is set at 14 cents per mile driven in service of charitable organizations. It’s important to note that this rate is subject to change annually, so it’s essential to stay updated with the latest information provided by the IRS.

Recordkeeping Requirements

In order to claim a deduction for mileage, it’s crucial to maintain accurate records of your volunteer work-related expenses. This includes documenting the number of miles driven, the purpose of the trip, and the date and time of each journey. It’s recommended to keep a detailed mileage log or use a mileage tracking app to ensure you have sufficient evidence to support your deduction.

Exceptions and Limitations

While the IRS allows deductions for mileage incurred during volunteer work, there are certain exceptions and limitations to be aware of. First and foremost, you cannot claim mileage deductions for personal commuting or other personal trips. The mileage must be directly related to your volunteer services. Additionally, if you have been reimbursed for any mileage expenses, you cannot claim a deduction for those specific amounts.

Itemizing Deductions

In order to deduct mileage for volunteer work, you must itemize your deductions on your tax return using Form 1040, Schedule A. This means forgoing the standard deduction, so it’s important to evaluate whether itemizing all your deductions outweighs taking the standard deduction. Consulting with a tax professional can help you determine the most advantageous approach for your situation.

Other Potential Deductions

While mileage is a common deduction associated with volunteer work, it’s worth noting that other expenses may also be deductible. If you incurred out-of-pocket expenses directly related to your volunteer activities, such as purchasing supplies or uniforms, these costs may also be eligible for deduction. Remember to keep detailed records and consult with a tax professional for accurate advice.

Consulting a Tax Professional

When it comes to navigating the complexities of tax deductions, particularly concerning volunteer work, it is always recommended to seek guidance from a qualified tax professional. They can provide personalized advice based on your specific circumstances and ensure that you claim any eligible deductions correctly, including mileage for your volunteer services.

Conclusion

Volunteering your time and energy to help others is truly commendable. While there are limitations and requirements surrounding the deduction of mileage for volunteer work, understanding the rules can help you maximize any potential tax benefits. By keeping accurate records, knowing the qualifying organizations, and consulting a tax professional when needed, you can confidently claim any eligible deductions and continue making a positive impact through your volunteer efforts.

Overview of Deducting Mileage for Volunteer Work

Deducting mileage for volunteer work is a common question among individuals who generously contribute their time and effort to various nonprofit organizations. While it is possible to claim deductions for mileage related to volunteer work, certain conditions must be met to qualify for this tax benefit.

Eligibility Criteria for Deducting Mileage

In order to deduct mileage for volunteer work, you must volunteer for a qualified charitable organization. Additionally, the travel must be for the sole purpose of performing volunteer services, and any reimbursement received for travel expenses should be excluded from tax deductions.

Recording and Calculating Mileage

To claim deductions for mileage, you need to maintain accurate records of your volunteer-related travel. This includes documenting the date, purpose of the trip, starting and ending locations, and the number of miles driven. You can then calculate the deductible mileage using either the standard mileage rate provided by the IRS or actual expenses incurred.

Standard Mileage Rate

The standard mileage rate set by the IRS changes annually and represents the cost per mile that may be deducted for volunteer-related travel. This rate aims to cover both fuel and vehicle-related expenses. It is crucial to stay updated on the current standard mileage rate to ensure accurate deductions.

Actual Expenses Method

Alternatively, you can choose to deduct actual expenses related to your volunteer work, such as gas, oil changes, and vehicle maintenance costs. However, documenting these expenses, including retaining receipts and invoices, is essential under this method.

Limitations on Deductible Mileage

It is important to note that there may be limitations on the amount of mileage you can deduct for volunteer work. Generally, the mileage must be directly related to the organization’s charitable activities, and any personal or commuting mileage is not eligible for deduction.

Filing Requirements and Documentation

When claiming deductions for volunteer-related mileage, it is necessary to itemize deductions on your tax return using Schedule A. Furthermore, be prepared to provide supporting documentation, such as mileage logs, records of volunteer services, and any written acknowledgments from the charitable organization.

Seeking Professional Advice

As tax laws and regulations are subject to change, it is always advisable to consult with a tax professional or seek advice from the IRS to ensure compliance and maximize your deductions when deducting mileage for volunteer work. They can offer personalized guidance based on your specific situation and help you navigate the complexities of tax deductions effectively.

As a professional, it is important to understand the rules and regulations surrounding the deduction of mileage for volunteer work. While volunteering is a noble act of giving back to the community, it is essential to navigate the tax implications correctly. Here is a professional point of view on whether you can deduct mileage for volunteer work:

Mileage Deduction Eligibility:

According to the Internal Revenue Service (IRS) guidelines, individuals cannot deduct the value of their time or services given to charitable organizations. However, they may be eligible to claim a deduction for the mileage expenses incurred while driving for volunteer work, as long as certain conditions are met.

Qualified Organizations:

In order to deduct mileage for volunteer work, the organization you are volunteering for must be a qualified tax-exempt organization under section 501(c)(3) of the IRS code. This generally includes nonprofit organizations, religious institutions, and government agencies. Before claiming any deductions, ensure that the organization meets this requirement.

Documentation and Record-Keeping:

To substantiate your mileage deduction, it is crucial to maintain accurate records. This includes recording the date, purpose, and number of miles driven for each volunteer trip. It is advisable to use a mileage log or a reliable tracking app to document this information. Remember, estimates or rough calculations will not hold up against an IRS audit, so keep detailed records.

Deductible Mileage:

Only the mileage directly related to volunteer work is deductible. This includes driving to and from the volunteer site, as well as any additional mileage incurred during the volunteer activity, such as running errands or attending meetings on behalf of the organization. Personal commuting mileage is not eligible for deduction.

Standard Mileage Rate:

The IRS provides a standard mileage rate that can be used to calculate the deductible mileage for volunteer work. It is important to check the current rate each year, as it may vary. For example, in 2021, the standard mileage rate for charitable purposes is set at 14 cents per mile. This rate covers both gasoline expenses and vehicle wear and tear.

Itemizing Deductions:

To claim the mileage deduction for volunteer work, you must itemize your deductions on Schedule A of your federal tax return. This means giving up the standard deduction. Consider consulting with a tax professional to determine if itemizing deductions would be more beneficial for your overall tax situation.

Remember, it is essential to consult with a qualified tax advisor or CPA to ensure compliance with tax laws and regulations. They can provide personalized advice based on your specific circumstances and assist you in maximizing your eligible deductions.

Thank you for visiting our blog today and taking the time to read about the topic of deducting mileage for volunteer work. We hope that you found the information helpful and informative, shedding light on an aspect of volunteering that is often overlooked. As always, we strive to provide professional and accurate content, so let us summarize the key points discussed in this article.

To begin with, it is important to understand that the IRS allows deductions for certain expenses related to volunteer work, including mileage. However, there are specific criteria that need to be met in order to qualify for these deductions. The volunteer work must be performed for a qualified organization, and any mileage claimed must be directly related to the services provided. It is also crucial to keep detailed records of your mileage, including the purpose of each trip and the total number of miles driven.

Furthermore, it is essential to note that the standard mileage rate set by the IRS is subject to change each year. Therefore, it is crucial to stay updated with the latest guidelines and consult with a tax professional or use reliable software to ensure accurate deductions. Taking advantage of these deductions can help offset the costs associated with volunteering and encourage more individuals to contribute their time and skills to worthy causes.

In conclusion, while volunteers provide invaluable services to their communities, it is important not to overlook the potential tax benefits available to them. By deducting mileage for volunteer work, individuals can reduce their taxable income and potentially receive a refund or lower their overall tax liability. However, it is crucial to adhere to the IRS guidelines and maintain detailed records to substantiate any deductions claimed. We hope this article has provided you with a clearer understanding of the topic and encourages you to explore the potential tax benefits you may be eligible for as a volunteer.

Once again, thank you for visiting our blog, and we look forward to sharing more valuable information with you in the future. If you have any further questions or would like to suggest future topics, please feel free to reach out. Happy volunteering!

Video Can I Deduct Mileage For Volunteer Work

Can I Deduct Mileage for Volunteer Work?

When it comes to deducting mileage for volunteer work, there are some important factors to consider. Here are the most commonly asked questions regarding this topic:

Is mileage for volunteer work tax deductible?

Yes, mileage for volunteer work can be tax deductible under certain circumstances. However, it is essential to meet specific requirements set by the Internal Revenue Service (IRS) to claim this deduction.

What are the requirements to deduct mileage for volunteer work?

The IRS requires that you volunteer for a qualified organization, meaning it must be a registered nonprofit or charity entity. Additionally, the miles you intend to deduct must be directly related to your volunteer service, and you should not have been reimbursed for these expenses.

How do I calculate the deductible mileage?

To calculate the deductible mileage for volunteer work, you can multiply the number of miles driven for volunteering by the standard mileage rate set by the IRS for the given tax year. The standard mileage rate is subject to change annually, so make sure to use the correct rate for the relevant tax year.

What other documentation do I need to support my mileage deduction?

It is crucial to keep detailed records and documentation to substantiate your mileage deduction. This includes maintaining a mileage log or record that indicates the date, purpose, and number of miles driven for each volunteer activity. Additionally, you may need to provide written acknowledgment from the qualifying organization confirming your volunteer work.

Are there any restrictions on deducting mileage for volunteer work?

Yes, there are restrictions on deducting mileage for volunteer work. For example, you cannot deduct mileage if you only volunteered for personal reasons, such as helping a friend or family member. Additionally, commuting mileage to and from your volunteer location is not deductible.

In conclusion, you may be eligible to deduct mileage for volunteer work if you meet the IRS requirements and maintain proper documentation. It is always recommended to consult with a tax professional or refer to the IRS guidelines for accurate information regarding your specific situation.