Table of Contents

Discover the tax benefits of volunteering with the IRS Deductions for Volunteer Work. Learn how your charitable contributions, travel expenses, and other related costs can be deducted to lower your taxable income. Find out how to qualify for these deductions and optimize your tax savings while making a positive impact on your community.

Are you someone who loves giving back to your community? Perhaps you spend your free time volunteering for various charitable organizations. If so, did you know that there may be a way for you to benefit financially from your selfless acts of kindness? The IRS offers deductions for volunteer work, allowing you to potentially reduce your taxable income while making a positive impact on the world around you. In this article, we will explore the various deductions available and how you can take advantage of them to maximize your contributions both to society and your own financial well-being.

Introduction

Volunteering is a noble act that allows individuals to give back to their communities, make a positive impact, and support causes they care about. While the rewards of volunteering are often intrinsic, it’s worth noting that there may be tax benefits associated with your volunteer work. The Internal Revenue Service (IRS) allows certain deductions for expenses incurred while carrying out volunteer activities. In this article, we will explore the potential deductions available for volunteer work and how you can take advantage of them.

The Nature of Volunteer Work

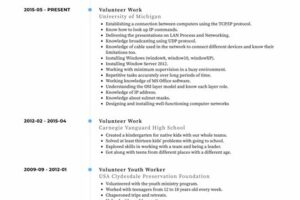

Before delving into the IRS deductions related to volunteer work, it’s important to understand what constitutes volunteer service. Volunteer work typically involves providing services to a qualified organization without receiving any compensation or expecting financial gain in return. This includes working for nonprofit organizations, religious institutions, government agencies, and other eligible entities.

Out-of-Pocket Expenses

When you volunteer, you may incur various out-of-pocket expenses related to your activities. Fortunately, some of these expenses may be deductible. It’s important to note that you cannot deduct the value of your time or services. However, eligible expenses such as transportation costs, parking fees, and supplies directly related to your volunteer work may qualify for deductions.

Transportation Costs

If you use your personal vehicle for volunteer work, you may be able to deduct the related transportation costs. This includes mileage driven for volunteer purposes, parking fees, and tolls. However, you must keep accurate records of your mileage and expenses to support your deductions. The IRS typically allows a deduction of a certain amount per mile driven for volunteering. Be sure to consult the latest guidelines or seek professional tax advice for the applicable rates.

Travel Expenses

If your volunteer work requires you to travel away from your regular place of residence, you may be eligible to deduct travel expenses. These expenses can include transportation, lodging, meals, and other related costs. However, it’s important to note that these deductions are subject to specific rules and limitations, so it’s advisable to consult the relevant IRS publications or a tax professional for guidance.

Supplies and Expenses

When you provide supplies or incur expenses directly related to your volunteer work, these costs may also be deductible. This can include items such as art supplies for teaching classes, office supplies for administrative work, or even uniforms or costumes required for specific volunteering roles. Keeping receipts and documentation is crucial to substantiate your deductions, so make sure to maintain accurate records of these expenses.

Training and Education Costs

Many volunteer organizations provide training and educational opportunities to enhance volunteers’ skills and knowledge. If you incur expenses for attending workshops, seminars, or other educational events directly related to your volunteer work, you may be able to claim deductions for these costs. As with any deduction, proper documentation is essential, so keep records of your attendance, registration fees, and any related expenses.

Limits and Documentation

While there are potential deductions available for volunteer work, it’s important to be aware of the limitations and requirements set forth by the IRS. To claim deductions, you must itemize your deductions using Schedule A of your tax return. Additionally, your total deductible expenses, including those for volunteer work, must exceed the standard deduction amount for your filing status.

Documentation Requirements

Proper documentation is crucial when deducting expenses related to volunteer work. It’s essential to retain receipts, invoices, canceled checks, or any other documents that support your deductions. Additionally, you should keep a detailed log of your volunteer activities, including dates, locations, organizations, and descriptions of the services provided. This information will help substantiate your deductions if requested by the IRS.

Tax Exempt Organizations

To claim deductions for volunteer work, it’s important to ensure that the organization you are working with is eligible to receive tax-deductible contributions. Most nonprofit organizations, religious institutions, and government agencies qualify. You can verify an organization’s tax-exempt status by checking the IRS’s Exempt Organizations Select Check tool on their website or consulting their list of tax-exempt organizations.

Seek Professional Advice

While this article provides an overview of the potential deductions for volunteer work, it’s always wise to seek professional tax advice specific to your situation. Tax laws and regulations can be complex, and a qualified tax professional can provide personalized guidance based on your individual circumstances. They can help you understand the applicable rules, maximize your deductions, and ensure compliance with IRS requirements.

Conclusion

Volunteering not only allows you to make a difference in your community but also offers the possibility of tax deductions for certain out-of-pocket expenses. By understanding the IRS deductions available for volunteer work and maintaining proper documentation, you can potentially reduce your taxable income while contributing to causes that matter to you. Remember, always consult a tax professional or refer to the latest IRS guidelines for accurate and up-to-date information on deductions for volunteer work.

IRS Deductions for Volunteer Work

When it comes to volunteer work, not only do individuals contribute their time and skills to charitable organizations, but they may also be eligible for tax deductions. However, it is important to understand the guidelines set by the Internal Revenue Service (IRS) to ensure that you are eligible for these deductions. This article will provide an overview of the key factors to consider when claiming IRS deductions for volunteer work.

Eligibility for Tax Deductions

Volunteers who itemize their deductions and meet certain criteria are eligible to claim expenses related to their volunteer work as tax deductions. It is crucial to note that the value of your time or services provided cannot be deducted. However, if you have incurred expenses while performing your volunteer work, you may be able to claim those expenses as deductions.

Qualified Charitable Organizations

In order to claim deductions, volunteers must work for qualified charitable organizations. These organizations must be registered with the IRS as tax-exempt under section 501(c)(3) of the Internal Revenue Code. Before claiming any deductions, it is essential to verify the organization’s status to ensure its eligibility.

Travel Expenses

Volunteers can deduct travel expenses incurred while performing their volunteer work, as long as they meet the IRS guidelines. This includes transportation costs such as airfare, train or bus tickets, and mileage if using their personal vehicle. However, it is important to note that personal expenses like sightseeing or vacations are not eligible for deductions.

Out-of-Pocket Expenses

Out-of-pocket expenses directly related to your volunteer work can be deducted. This may include purchasing supplies, ingredients, or any materials necessary for the charitable organization. To support your deductions, it is crucial to keep detailed records and retain receipts.

Uniform Costs

If your volunteer work requires a uniform, the cost of purchasing and cleaning it may be tax-deductible. However, the uniform should not be suitable for everyday wear. It is important to note that any expenses related to personal grooming or maintaining the uniform, such as dry cleaning or alterations, are not eligible for deductions.

Training and Educational Expenses

Expenses incurred for training or educational purposes directly related to your volunteer work can be claimed as deductions. This includes workshops, seminars, or conferences that enhance your skills and knowledge in your volunteer role. However, expenses for obtaining formal education or courses that lead to a degree or certification are not deductible.

Donations Made While Volunteering

If you make any cash or non-cash donations to the organizations you volunteer for, you may be able to deduct these contributions. It is important to ensure that you receive proper documentation from the charitable organization acknowledging your donation, as it may be required for tax deductions.

Documentation and Recordkeeping

To ensure a smooth process during tax filing and in case of an audit, it is vital to maintain accurate records. This includes keeping receipts, acknowledgments from the charitable organizations, and any other documents supporting your volunteer work and associated expenses. These records should be kept for at least three years after you file your tax return.

Remember, consulting with a tax professional or using tax preparation software can help ensure that you take advantage of all eligible deductions while staying within the IRS guidelines for volunteering deductions. By following these guidelines and maintaining detailed records, volunteers can potentially reduce their taxable income and maximize their contributions towards charitable causes.

In my professional opinion, the deductions provided by the Internal Revenue Service (IRS) for volunteer work play a crucial role in recognizing and encouraging the contributions made by individuals who selflessly devote their time and skills to help others. These deductions not only provide financial relief to volunteers but also serve as an acknowledgment of their valuable services to society.

Here are some key points regarding IRS deductions for volunteer work:

- Tax-exempt Organizations: The IRS allows deductions for volunteer work performed for certain tax-exempt organizations, such as non-profit charities, religious institutions, and government agencies. This recognition ensures that volunteers can claim deductions for their unreimbursed expenses incurred while performing volunteer services.

- Eligible Deductible Expenses: Volunteers can deduct various expenses directly related to their volunteer work. These may include transportation costs, such as mileage or public transportation fares, travel expenses, meals and lodging (in certain cases), and expenses incurred for purchasing supplies or materials needed for volunteering. However, it is important to note that personal expenses or expenses reimbursed by the organization are generally not eligible for deductions.

- Documentation Requirements: To claim deductions for volunteer work, individuals must maintain proper documentation. This includes keeping records of the date, place, and purpose of each volunteer activity, along with receipts and other substantiation for expenses claimed. Accurate record-keeping is essential to support deductions and ensure compliance with IRS regulations.

- Value of Services: While the IRS does not allow deductions for the value of volunteer services rendered, it is essential to recognize that volunteers contribute valuable expertise, time, and effort to benefit the community. The deductions for expenses incurred during volunteer work help compensate for some of the costs borne by volunteers and encourage their continued dedication.

- Limitations and Restrictions: It is important to note that there are limitations and restrictions on the deductions for volunteer work. For example, volunteers cannot deduct the value of their time or services, nor can they claim deductions for personal expenses or services provided to individuals. Additionally, deductions may be subject to certain percentage limits based on the individual’s adjusted gross income.

In conclusion, the IRS deductions for volunteer work serve as a valuable recognition of the selfless contributions made by individuals who donate their time and skills to help others. These deductions provide financial relief and incentivize continued volunteerism. However, it is crucial for volunteers to understand the eligibility criteria, maintain proper documentation, and comply with the IRS regulations to ensure the legitimacy of their deductions.

Thank you for visiting our blog and taking the time to learn about IRS deductions for volunteer work. In today’s article, we have provided you with valuable insights on how you can potentially benefit from your charitable efforts through tax deductions. We hope that this information has been helpful and informative to you.

As we all know, volunteering is a selfless act that allows us to give back to our communities and make a positive impact on the lives of others. It is important to understand that while there are no monetary rewards for volunteering, the IRS provides certain provisions that could help alleviate some of the financial burden associated with charitable work.

First and foremost, it is crucial to keep detailed records of your volunteer activities. This includes documenting the dates, times, and nature of your services, as well as any out-of-pocket expenses incurred while performing these tasks. By maintaining accurate records, you will have the necessary documentation to support your deductions in case of an IRS audit.

When it comes to deductions, the IRS allows volunteers to deduct unreimbursed expenses directly related to their volunteer work. This may include costs such as transportation, meals, and supplies. However, it is important to note that these expenses must be directly connected to your volunteer work and not of a personal nature.

In conclusion, while volunteering is primarily driven by the desire to make a difference, it is comforting to know that the IRS recognizes the value of these selfless acts. By taking advantage of the deductions available for volunteer work, you can potentially reduce your tax liability and further support the causes that are dear to your heart. Remember to consult with a tax professional or refer to IRS guidelines for specific details and qualifications.

Once again, thank you for reading our blog and we hope that this article has provided you with useful information regarding IRS deductions for volunteer work. We encourage you to continue your philanthropic efforts and make a positive impact in your community. If you have any further questions or would like to share your thoughts, please feel free to leave a comment below. We appreciate your support and wish you all the best in your volunteer endeavors!

.

People also ask about IRS deductions for volunteer work:

Can I claim a tax deduction for volunteering?

What types of volunteer expenses can be deducted?

Are there any limitations on the volunteer deductions?

Do I need to keep records of my volunteer expenses?

How do I claim the volunteer expense deductions on my tax return?

Can I deduct volunteer expenses if I receive any benefits in return?

Yes, you may be eligible to claim a tax deduction for volunteering if you itemize your deductions on your federal tax return. However, it’s important to note that only certain expenses directly related to your volunteer work are deductible.

The IRS allows deducting certain expenses incurred while performing volunteer work, such as travel expenses directly related to the volunteer activity, unreimbursed out-of-pocket expenses, and the cost of purchasing and maintaining uniforms required for volunteering.

Yes, there are limitations on volunteer deductions. The expenses must be incurred solely for the purpose of volunteering for a qualified organization, and you cannot deduct the value of your time or services rendered as a volunteer.

Yes, it is crucial to keep detailed records of your volunteer expenses in order to substantiate your deductions. This includes saving receipts, keeping a mileage log, and documenting any other expenses related to your volunteer work.

You can claim volunteer expense deductions by using Form 1040, Schedule A, and itemizing your deductions. Report the total amount of your volunteer expenses under the section for miscellaneous deductions, subject to the 2% adjusted gross income (AGI) threshold.

If you receive substantial benefits in return for your volunteer work, such as free tickets to an event or discounted membership fees, the value of those benefits may reduce the deductible amount of your expenses. It’s important to consult IRS guidelines or seek professional tax advice in such cases.