Table of Contents

Are you wondering if mileage for volunteer work is tax deductible? Find out the answer and learn about the requirements and limitations for claiming this deduction. Discover how volunteering can potentially reduce your tax liability while making a positive impact on your community.

Are you a dedicated volunteer who spends countless hours giving back to your community? If so, you may be wondering if the mileage you accrue while performing volunteer work is tax deductible. Well, the good news is that in certain situations, mileage for volunteer work can indeed be deducted on your taxes. However, there are specific guidelines and qualifications you need to meet in order to take advantage of this tax benefit. In this article, we will explore the criteria and rules surrounding the tax deductibility of mileage for volunteer work, ensuring that you have all the necessary information to make the most of your efforts while maximizing your tax savings.

Introduction

Volunteering is a noble act that not only helps others but also brings immense personal satisfaction. Many people wonder if they can deduct the expenses incurred during volunteer work from their taxes, particularly mileage. In this article, we will explore whether mileage for volunteer work is tax deductible.

Understanding Tax Deductions

Tax deductions are a way to reduce your taxable income, lowering the amount of tax you owe. Deductions are typically available for certain expenses related to specific activities or circumstances, such as business expenses, medical expenses, and charitable contributions.

Charitable Contributions and Volunteering

When it comes to volunteering, the IRS allows taxpayers to deduct certain expenses associated with their charitable contributions. However, it’s important to note that you cannot deduct the value of your time or services provided as a volunteer.

Mileage Deductions for Volunteer Work

One of the eligible deductions for volunteer work is mileage. If you use your personal vehicle for volunteer activities, you may be able to deduct the mileage driven for these purposes. However, there are specific conditions that need to be met in order to qualify for this deduction.

Qualifying for Mileage Deductions

In order to claim mileage deductions for volunteer work, you must meet the following criteria:

- You must be volunteering for a qualified charitable organization

- Your volunteer work must be genuine and unreimbursed

- You must keep a detailed record of your mileage, including dates, destinations, and the purpose of each trip

Qualified Charitable Organizations

The IRS defines qualified charitable organizations as non-profit entities that operate for religious, charitable, educational, scientific, or literary purposes. Examples of qualified organizations include churches, schools, hospitals, and other registered non-profits.

Calculating Mileage Deductions

To calculate your mileage deductions, you can use either the standard mileage rate set by the IRS or your actual expenses. The standard mileage rate for volunteer work is typically adjusted annually and is an amount per mile driven. It covers both fuel costs and vehicle wear and tear.

Documenting Your Mileage

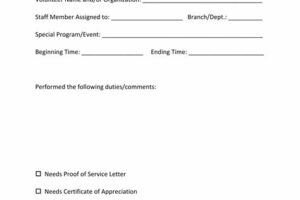

Keeping accurate records of your mileage is crucial when claiming deductions for volunteer work. You should maintain a mileage log that includes the following information:

- Date of each trip

- Starting and ending locations

- Total miles driven

- Purpose of the trip

Other Deductible Volunteer Expenses

In addition to mileage, there may be other expenses related to your volunteer work that you can deduct. These could include supplies, uniforms, parking fees, tolls, and other out-of-pocket costs directly associated with your volunteer activities. It’s important to keep receipts and documentation for these expenses as well.

Consulting a Tax Professional

While understanding the rules surrounding deductions for volunteer work can be complex, it is always advisable to consult a tax professional or use reputable tax software to ensure you are following the correct guidelines and maximizing your deductions within the law.

Conclusion

Volunteering not only benefits the community but also provides an opportunity for certain tax deductions. Mileage for volunteer work can be tax deductible, provided you meet the necessary criteria and maintain accurate records. Remember to consult a tax professional to ensure you are taking advantage of all available deductions and complying with IRS regulations.

Introduction to Mileage Deductions for Volunteer Work

Many individuals wonder if mileage expenses for volunteer work are tax deductible and if they can potentially save on their tax liabilities. Mileage deductions for volunteer work refer to the expenses incurred while using your personal vehicle for charitable purposes.

Understanding Charitable Mileage Deductions

The Internal Revenue Service (IRS) allows taxpayers to claim deductions for mileage incurred while performing volunteer work for qualified nonprofit organizations. To determine whether your mileage expenses for volunteer work are eligible for tax deductions, it is important to understand the specific guidelines and requirements set by the IRS.

Qualified Charitable Organizations

Your volunteer work must be performed for qualified charitable organizations recognized by the IRS in order to be eligible for tax deductions. These organizations typically include religious, educational, scientific, literary, and charitable institutions. It is crucial to ensure that the organization you volunteer for is legitimate and meets the IRS criteria.

Mileage Calculation Methods

The IRS offers two methods for calculating deductible mileage: the standard mileage rate and the actual cost method. The standard mileage rate is a predetermined amount per mile set by the IRS each year, while the actual cost method involves tracking and deducting the actual vehicle-related expenses incurred while volunteering.

Standard Mileage Rate

The standard mileage rate is the simpler option for most taxpayers. As of the 2021 tax year, the standard mileage rate is 14 cents per mile driven for charitable purposes. To claim this deduction, you must keep accurate records of the number of miles driven for volunteer work throughout the year.

Actual Cost Method

If you choose to use the actual cost method, you must maintain detailed records of every expense related to your vehicle, such as gas, oil changes, repairs, and insurance. However, it is important to note that if you choose this method, you cannot deduct any other vehicle-related expenses, such as lease payments or depreciation.

Documentation and Record-Keeping

In order to claim mileage deductions for volunteer work, it is crucial to maintain accurate records and documentation. This includes tracking the date, purpose, and number of miles driven for each volunteering activity. It is recommended to keep a mileage log, receipts, and any other relevant documents that support your deduction claims.

Consultation with a Tax Professional

To ensure accurate and compliant tax deductions, it is advisable to seek the guidance of a qualified tax professional. They can assist you in understanding the specific IRS regulations, help you calculate your deductions, and ensure that you meet all the necessary requirements for claiming mileage deductions for your volunteer work.

Staying Up to Date with IRS Guidelines

Remember, tax laws and regulations change periodically, so it is essential to stay up to date with the latest IRS guidelines regarding mileage deductions for volunteer work to maximize your potential tax benefits.

In my professional opinion, mileage for volunteer work can be tax deductible under certain circumstances. However, it is important to understand the specific guidelines and requirements set forth by the Internal Revenue Service (IRS) in order to determine if your mileage for volunteer work qualifies for tax deductions.

Here are some key points to consider:

- Eligibility: To qualify for tax deductions on mileage for volunteer work, you must be volunteering for a qualified organization that is recognized as a nonprofit entity by the IRS. This includes charitable, religious, educational, and scientific organizations.

- Documentation: It is crucial to maintain accurate records of your mileage for volunteer work. This includes recording the date, purpose, and number of miles driven for each volunteer activity. Additionally, you should keep any supporting documents, such as emails or letters from the organization, to substantiate your claims.

- Standard Mileage Rate: The IRS sets a standard mileage rate each year, which is the amount you can deduct per mile driven for volunteer work. It is essential to check the current rate as it may vary annually.

- Qualifying Expenses: While mileage is typically the most common expense eligible for tax deductions, other out-of-pocket expenses incurred during volunteer work may also be deductible. These can include parking fees, tolls, and public transportation costs directly related to your volunteer activities.

- Personal vs. Commuting Miles: It is important to note that only the mileage directly associated with your volunteer work is tax deductible. Commuting to and from your place of volunteer work is considered personal mileage and is not eligible for deductions.

It is recommended to consult with a tax professional or refer to the IRS guidelines (Publication 526) for further clarification and to ensure compliance with all requirements. They can provide personalized advice based on your specific situation, helping you maximize your tax deductions while adhering to the tax laws.

Please note that this response is based on general information and should not substitute professional tax advice. Each individual’s circumstances may vary, and it is always best to consult with a qualified tax professional.

Thank you for taking the time to visit our blog and read our article on whether mileage for volunteer work is tax deductible. We hope that we have provided you with valuable information and insights into this topic. As we wrap up, we would like to offer a brief summary of the key points discussed in the article.

In the first paragraph, we explored the concept of tax deductions for mileage related to volunteer work. We discussed how the IRS allows individuals to deduct mileage expenses incurred while performing services for qualified organizations. However, it is crucial to note that these deductions are only applicable if the volunteer work is done for a recognized charitable, religious, or governmental organization. Additionally, the mileage must be directly related to the volunteer work and not include personal or commuting mileage.

In the second paragraph, we delved into the specific requirements for claiming mileage deductions. We highlighted the importance of maintaining accurate records of mileage, including the date, destination, purpose, and number of miles traveled. These records are essential when it comes to calculating the deductible amount accurately. Furthermore, we emphasized that it is essential to differentiate between unreimbursed volunteer mileage and mileage that has already been reimbursed, as only the former is eligible for tax deductions.

In the final paragraph, we addressed potential limitations and considerations regarding mileage deductions for volunteer work. We explained that while mileage deductions can provide tax benefits, it is essential to consult with a tax professional or refer to IRS guidelines to ensure compliance with the latest regulations and requirements. Additionally, we mentioned that volunteers should keep in mind that other expenses related to volunteering, such as parking fees or tolls, may also be eligible for deduction.

We hope that this article has shed light on the question of whether mileage for volunteer work is tax deductible. Remember, always seek professional advice when it comes to tax matters, as regulations can vary and change over time. We appreciate your readership and encourage you to explore our blog further for more informative content. Thank you, and happy volunteering!

Video Is Mileage For Volunteer Work Tax Deductible

Is Mileage for Volunteer Work Tax Deductible?

When it comes to tax deductions, many people wonder if they can claim mileage for volunteer work. Here are some commonly asked questions regarding this topic:

- Can I deduct mileage for volunteering?

- What are the requirements for deducting mileage for volunteer work?

- The organization you are volunteering for must be a qualified charitable organization recognized by the IRS.

- You must have incurred the mileage while performing services for the charitable organization.

- The mileage must be necessary and directly related to the volunteer services you provided.

- You cannot deduct mileage if you only volunteered for personal reasons or if you were reimbursed for the expenses.

- How do I calculate the deductible mileage for volunteer work?

- Are there any limitations on deducting mileage for volunteer work?

- What documentation do I need to support my mileage deduction?

Yes, you may be able to deduct mileage for volunteering under certain circumstances. The Internal Revenue Service (IRS) allows volunteers to deduct their transportation expenses if they meet certain criteria.

In order to deduct mileage for volunteer work, you must meet the following requirements:

To calculate the deductible mileage for volunteer work, you can use the standard mileage rate set by the IRS. For the tax year 2021, the standard mileage rate for charitable purposes is 14 cents per mile. Keep track of your volunteer miles throughout the year and multiply the total number of miles by the applicable rate to determine your deduction.

Yes, there are limitations on deducting mileage for volunteer work. You cannot claim deductions for mileage if you received any form of reimbursement, such as a flat-rate expense allowance. Additionally, you cannot deduct mileage if the value of your time or services can be considered a personal benefit.

To support your mileage deduction for volunteer work, it is important to keep accurate records. This includes maintaining a mileage log that documents the date, purpose, starting location, destination, and number of miles driven for each volunteer trip. It is also advisable to retain receipts, volunteer schedules, or any other documentation that validates your volunteer work.

Remember, tax laws can be complex, and it is always recommended to consult with a tax professional or refer to the official IRS guidelines to ensure compliance and accuracy when claiming deductions.