Table of Contents

Are you wondering if volunteer work is tax deductible? Find out the eligibility criteria and rules for claiming deductions on your taxes for charitable contributions and volunteer work. Learn how to maximize your tax benefits while giving back to your community.

Volunteer work is not only a selfless act of kindness, but it also has the potential to provide some financial benefits. Many people wonder if their volunteer efforts can be considered tax-deductible, ultimately reducing their taxable income. Well, the good news is that there are certain situations where volunteer work can indeed be eligible for tax deductions. However, it is essential to navigate the complex terrain of tax regulations and guidelines to ensure you meet the necessary criteria. In this article, we will explore the various factors that determine whether your volunteer work qualifies for tax deductions, empowering you with the knowledge to make the most of your philanthropic endeavors while maximizing your financial advantage.

Introduction

Volunteer work is a noble act that many individuals choose to engage in to make a positive impact on their communities. Whether it involves helping the less fortunate, supporting charitable organizations, or participating in community events, volunteer work plays a crucial role in society. However, many people wonder if the expenses incurred during volunteer work can be tax deductible. In this article, we will explore the concept of tax deductions for volunteer work and shed light on the guidelines provided by tax authorities.

Understanding Volunteer Work

Before delving into the tax implications, it is important to clarify what constitutes volunteer work. Generally, volunteer work refers to services provided to non-profit organizations or governmental entities without receiving any financial compensation. It is a selfless act driven by the desire to contribute to the greater good rather than personal gain. Volunteer work can encompass a wide range of activities, such as assisting at food banks, tutoring students, mentoring young individuals, or engaging in environmental conservation efforts.

Non-Deductible Volunteer Expenses

While volunteer work might qualify for certain tax deductions, it is essential to understand that not all expenses associated with volunteering are eligible. The Internal Revenue Service (IRS) explicitly states that you cannot deduct the value of your time or services as a charitable contribution. This means that the hours you spend volunteering cannot be converted into a monetary deduction on your tax return. Tax deductions for volunteer work revolve around out-of-pocket expenses directly related to your volunteer activities.

Eligible Deductible Expenses

Although you cannot deduct your time, there are several expenses that might be eligible for tax deductions. Some common examples include:

- Transportation expenses: If you incur costs while traveling to and from your volunteer work, such as gas, parking fees, or public transportation fares, you may be able to deduct these.

- Uniforms or supplies: If you are required to wear a specific uniform or purchase supplies for your volunteer work, the expenses incurred can potentially be tax deductible.

- Training or educational costs: If you need to undergo training or educational programs directly related to your volunteer activities, these expenses might be eligible for deduction.

Record-Keeping Requirements

When it comes to claiming deductions for volunteer work, maintaining proper records is crucial. The IRS requires individuals to keep documentation supporting their expenses. This includes receipts, invoices, bank statements, or any other relevant documents that demonstrate the amount spent and the purpose of the expense. It is advisable to create a dedicated folder or digital file to organize and store all receipts and records related to your volunteer work expenses.

Calculating Deductible Expenses

To determine the amount of eligible expenses for tax deduction, you should keep track of each expense incurred. Maintain a log or spreadsheet where you record the date, purpose, and amount of each expense. At the end of the year, you can add up these expenses and use them when filing your taxes. It is recommended to consult with a tax professional or refer to IRS guidelines to ensure accurate calculation and reporting of deductible expenses.

Tax Forms and Reporting

When claiming deductions for volunteer work, it is important to use the appropriate tax forms and follow the required reporting procedures. The IRS provides Form 1040, Schedule A, where you can list your deductible expenses under the section for charitable contributions. Ensure that you accurately complete the form and include all relevant details to support your deductions. If you are unsure about the process, seeking guidance from a tax professional can help ensure compliance with tax regulations.

State-Specific Considerations

It is worth noting that while the IRS provides federal guidelines for tax deductions, state-specific regulations may differ. Some states have their own rules regarding the deductibility of volunteer work expenses. Therefore, it is essential to research and understand the tax regulations specific to your state before claiming deductions for volunteer work on your state tax return.

The Importance of Consulting a Tax Professional

Given the complex nature of tax laws and regulations, consulting a tax professional is highly recommended when determining the deductibility of volunteer work expenses. A tax professional can guide you through the process, ensure accurate reporting, and help maximize your eligible deductions. They can also provide advice on state-specific regulations and any recent changes in tax laws that may impact your deductions.

Conclusion

While volunteer work itself cannot be directly deducted from your taxes, certain out-of-pocket expenses incurred during volunteer activities may be eligible for tax deductions. Understanding the guidelines provided by the IRS, maintaining proper records, and consulting a tax professional are essential steps to ensure compliance with tax regulations and maximize your eligible deductions. By doing so, you can continue making a positive impact on your community while potentially benefiting from tax savings.

Introduction

Volunteer work plays a pivotal role in our society, with countless individuals generously donating their time and skills to make a difference. One common question that often arises is whether the expenses incurred while volunteering can be claimed as tax deductions. In this article, we will delve into this topic to provide a comprehensive understanding of the tax implications of volunteer work.

Types of Volunteer Services

While volunteer work encompasses a wide range of activities, it is important to understand that not all services qualify for tax deductions. Generally, only services provided to qualified nonprofit organizations are eligible. These may include charities, religious organizations, or government agencies. To determine if your volunteer work is tax deductible, it is crucial to identify the type of organization you are serving.

Unreimbursed Expenses

In some instances, volunteers may incur expenses directly related to their service, such as transportation costs, uniform expenses, or equipment purchases. However, it is essential to note that to be tax deductible, these expenses must be both unreimbursed and directly connected to the volunteer services provided. Keeping detailed records, including receipts and documentation of these expenses, is important when claiming deductions.

Travel Expenses

Volunteer work sometimes requires individuals to travel, whether within their local community or even internationally. When it comes to deducting travel expenses, volunteers should be aware of the specific criteria set by the Internal Revenue Service (IRS). Generally, travel expenses are tax deductible if the travel is primarily for volunteer work, you are not reimbursed, and it is not considered personal, living, or family expenses.

Meal Expenses

Another expense that volunteers may encounter during their service is meals. Similar to travel expenses, meal expenses incurred while volunteering can be tax deductible under specific circumstances. These include situations where meals are necessary for volunteering activities, are not lavish or extravagant, and are not personal or family expenses. Understanding the IRS guidelines can help ensure accurate deductions related to meals.

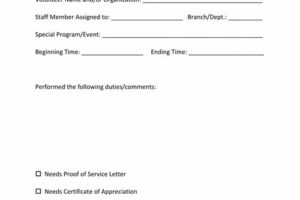

Documentation and Record-keeping

To benefit from potential tax deductions, volunteers need to maintain accurate documentation and records of their expenses. Examples of necessary records include receipts, mileage logs, and any other relevant documents that substantiate the expenses incurred. Maintaining detailed records ensures compliance with IRS requirements and provides the necessary evidence in the event of an audit.

Monetary Donations

Apart from actual expenses, volunteers may also contribute financially to the organizations they serve. Monetary donations made to qualified nonprofit organizations are generally tax deductible. However, it is important to remember that a contribution must meet specific requirements outlined by the IRS to be claimed as a qualified deduction. Ensuring the donation is made to an eligible organization and following any additional guidelines will aid in maximizing tax benefits.

Seek Professional Guidance

Navigating the complexities of tax deductions related to volunteer work can be challenging. As tax laws are subject to change, seeking professional guidance from a tax advisor or certified public accountant (CPA) can ensure accurate understanding and proper compliance. These professionals can provide tailored advice and assist in maximizing any potential tax benefits associated with volunteer work.

Volunteer work is a noble endeavor that allows individuals to make a positive impact on their communities and society as a whole. It is often driven by the desire to give back, help others, and contribute to causes that one believes in. While the primary motivation for volunteering is not monetary gain, it is natural for individuals to wonder if their volunteer efforts can have any tax benefits. In this regard, it is important to understand the tax implications of volunteer work and whether it is tax deductible.

1. Volunteer work is generally not tax deductible:

- According to the United States Internal Revenue Service (IRS), volunteer work is not tax deductible if it involves personal services provided to individuals or organizations. This means that the value of the time and services donated cannot be deducted from one’s taxable income.

- Individuals cannot claim deductions for the value of their time or skills spent on volunteering, regardless of the amount of time dedicated or the level of expertise involved.

2. Deductible expenses related to volunteer work:

- While the time and services offered as a volunteer are not tax deductible, there are certain out-of-pocket expenses that may be eligible for deductions.

- Expenses incurred for travel, meals, and supplies directly related to volunteer work may qualify for deductions. However, these expenses must meet specific criteria set by the IRS, including being incurred solely for volunteer purposes and not reimbursed by the organization.

- It is crucial to keep accurate records and receipts of all expenses related to volunteer work in order to substantiate any potential deductions.

3. Charitable contributions versus volunteer work:

- It is important to differentiate between volunteer work and charitable contributions, as they have different tax implications.

- Charitable contributions, such as monetary donations or the donation of goods, may be tax deductible if made to qualified nonprofit organizations. These deductions are subject to specific rules and limitations outlined by the IRS.

- Volunteer work, on the other hand, cannot be considered a charitable contribution for tax deduction purposes, as it involves the donation of time and services rather than money or tangible assets.

4. Consultation with a tax professional:

- Given the complexities of tax laws and regulations, it is advisable to consult with a tax professional or seek guidance from the IRS directly if there are any uncertainties regarding the tax deductibility of volunteer work or related expenses.

- A qualified tax professional can provide accurate information and help individuals understand the specific rules applicable to their situations, ensuring compliance with tax regulations.

In conclusion, volunteer work, while commendable and impactful, is generally not tax deductible. The value of time and services offered as a volunteer cannot be deducted from one’s taxable income. However, certain out-of-pocket expenses directly related to volunteer work may be eligible for deductions, provided they meet the IRS criteria. It is crucial to keep detailed records and consult with a tax professional to ensure compliance with tax regulations and maximize eligible deductions.

Thank you for taking the time to visit our blog and learn more about whether volunteer work is tax deductible. We hope that the information provided has been helpful in clarifying any uncertainties you may have had regarding this topic. Before we conclude, let’s summarize the key points discussed throughout the article.

Firstly, it is important to note that while volunteer work is commendable and greatly appreciated by society, it is generally not tax deductible for individuals. The Internal Revenue Service (IRS) does not allow deductions for the value of your time or services provided as a volunteer. However, there are certain expenses related to volunteer work that can be considered tax deductible under specific circumstances.

If you incur out-of-pocket expenses directly related to your volunteer work, such as purchasing supplies or materials, these expenses may be eligible for tax deductions. It is crucial to keep detailed records and receipts of these expenses, as they will be required when filing your tax return. Additionally, if you use your personal vehicle for volunteer activities, you may be able to deduct the mileage or actual expenses incurred.

In conclusion, while volunteer work itself is not tax deductible, certain expenses associated with volunteering can be claimed as deductions. It is essential to consult with a tax professional or refer to the IRS guidelines to determine your eligibility for these deductions. Remember to maintain accurate records of your expenses to support your claims.

We hope that this article has provided you with a clear understanding of the tax implications of volunteer work. Engaging in volunteer activities not only benefits the community but also brings personal fulfillment and satisfaction. If you have any further questions or need more information, please feel free to explore other resources or reach out to a qualified tax advisor. Thank you once again for visiting our blog, and we wish you all the best in your future volunteer endeavors!

.

1. Is volunteer work tax deductible?

Yes, in certain circumstances, volunteer work can be tax deductible.

2. What types of volunteer work are tax deductible?

The IRS allows tax deductions for volunteer work if it is done for a qualified charitable organization, such as a nonprofit organization or a government entity. Examples of eligible volunteer work include providing services at a homeless shelter, participating in community cleanup efforts, or serving meals at a soup kitchen.

3. Can I deduct expenses incurred while volunteering?

Yes, you may be able to deduct certain unreimbursed expenses related to your volunteer work. This could include costs for transportation, parking fees, and supplies directly related to the volunteer activity. However, it’s important to keep accurate records and receipts to support your deductions.

4. Are there any limitations on volunteer work tax deductions?

Yes, there are some limitations on volunteer work tax deductions. For example, you cannot deduct the value of your time or services provided as a volunteer. Additionally, if you receive any benefits or compensation in return for your volunteer work, such as free tickets to an event, the value of those benefits may reduce the amount you can deduct.

5. How do I claim a tax deduction for my volunteer work?

To claim a tax deduction for your volunteer work, you will need to itemize your deductions on your tax return using Schedule A (Form 1040). You should keep detailed records of your volunteer activities, including dates, times, and descriptions, as well as any related expenses. It is advisable to consult with a tax professional or refer to the IRS guidelines for specific instructions on how to claim the deduction.

6. Can I deduct volunteer work if I am self-employed?

If you are self-employed and volunteer your services, you may be able to deduct certain expenses related to your volunteer work as business expenses. However, the same limitations and rules mentioned earlier still apply. It is recommended to consult with a tax professional to ensure you meet all the requirements for claiming deductions as a self-employed individual.

7. Are there any other benefits to volunteering besides tax deductions?

Absolutely! While tax deductions can be a nice benefit, volunteering offers numerous other rewards. It allows you to make a positive impact on your community, gain valuable skills and experience, expand your network, and create meaningful connections with others. Volunteering can also enhance your personal and professional growth, boost your self-esteem, and provide a sense of fulfillment and purpose.