Famous Volunteer Opportunities Richmond Va References

September 17, 2023

0 comment

Incredible Volunteer Match Mn Ideas

September 17, 2023

0 comment

Cool Volunteer Match Columbus Ohio 2023

September 14, 2023

0 comment

Incredible Volunteermatch Webinars References

September 13, 2023

0 comment

+10 Volunteer Opportunities Denver Ideas

September 12, 2023

0 comment

Incredible Volunteer Opportunities Guelph 2023

September 9, 2023

0 comment

The Best Volunteer Match Michigan 2023

September 7, 2023

0 comment

The Best Volunteer Opportunities Victoria 2023

September 6, 2023

0 comment

List Of Volunteer Opportunities Kingston References

September 5, 2023

0 comment

September 15, 2023

0 comment

'Whimsical' sculpture to honor Naperville Humane Society founders from www.dailyherald.com Are you an animal lover looking to...

Famous London Animal Shelter Volunteer References

September 14, 2023

0 comment

Famous Animal Shelter Volunteer Coordinator Job Description Ideas

September 12, 2023

0 comment

Incredible Denton Animal Shelter Volunteer Ideas

September 11, 2023

0 comment

+26 Animal Shelter Volunteer Waiver Forms 2023

September 10, 2023

0 comment

March 16, 2024

0 comment

The Memphis Volunteer Fire Department is a dedicated team of courageous individuals who selflessly serve their community....

Latest Posts

April 25, 2024

0 comment

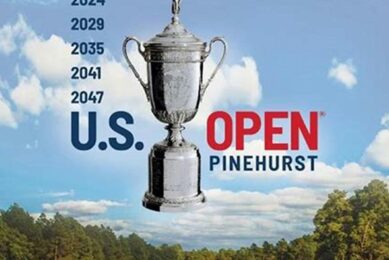

The US Open, one of the world’s most prestigious tennis tournaments, is an event that brings together...

The Definition of a Volunteer : A Source of Inspiration

April 25, 2024

0 comment

The Blood Drive Volunteer: A Guide to Getting Involved

April 25, 2024

0 comment